Effectiveness of Alcohol Tax Policy Intervention for Reducing Violent Mortality Rates in Russia

*Corresponding Author(s):

Yury Evgeny RazvodovskyDepartment Of Psychiatry, Grodno State Medical University, Belarus, Russian Federation

Tel:+375 0152701884,

Email:yury_razvodovsky@mail.ru

Abstract

Background: Many experts believe that binge drinking of vodka is the main cause of the strikingly high mortality from external causes in Russia.

Objectives: To assess the relationship between alcohol taxes and violent mortality rates in Russia from 2010 to 2015.

Methods: Trends in the excise tax rates for vodka and violent mortality rates between 2010 and 2015 were compared.

Results: Spearman’s correlation analysis suggests a statistically significant inverse relationship between excise tax rates for vodka and suicides, homicides, accidental drowning, mortality due to exposure to smoke, fire and flames and fatal falls.

Conclusions: The results of this study suggest an inverse aggregate-level relationship between excise tax rates for vodka and violent mortality rates in Russia. Given this evidence, raising excise tax rates for vodka appears to be an effective policy to reduce violent mortality rates in Russia.

Keywords

INTRODUCTION

Since binge drinking has numerous adverse health consequences, a consumer response to changes in the affordability of alcohol is an important research topic. A growing international literature has explored the impact of alcohol taxes on alcohol-related harm [7-9]. The vast majority of these studies provide consistent evidence that higher taxes on alcohol are linked to lower alcohol-related mortality [10]. In addition, there is consensus among researchers that the increase in alcohol excise taxes on alcohol is one of the most effective interventions to reduce binge drinking and alcohol-related harm [11].

Natural experiments, such as sudden changes in the taxation of alcohol, provide an opportunity to test the effectiveness of policies to reduce alcohol-related harm. Russia, due to its high overall level of consumption and hazardous drinking pattern provides an important contextual setting for this type of analysis [1]. The historical perspective suggests that prior attempts to mitigate alcohol-related problems in Russia have failed, mainly because of the increased consumption of various forms of surrogate alcohol [12]. Over the past decade, the Russian government adopted a series of the alcohol policy measures in an attempt to curb the alcohol-related burden [13]. The policies included a substantial increase in excise taxes on alcohol products, which led to an increase in consumer prices [14]. Excise tax rates for vodka in Russia increased dramatically between 2010 and 2015 [13]. Making vodka less affordable through differential taxation has become an essential element of the Russian alcohol policy [15].

Against this background, it will be interesting to evaluate the impact of the recent alcohol tax policy that was implemented in Russia on violent mortality rates. Thus, the aim of this study was to examine the relationship between changes in the tax on vodka and mortality from external causes in Russia between 2010 and 2015.

METHODS

RESULTS

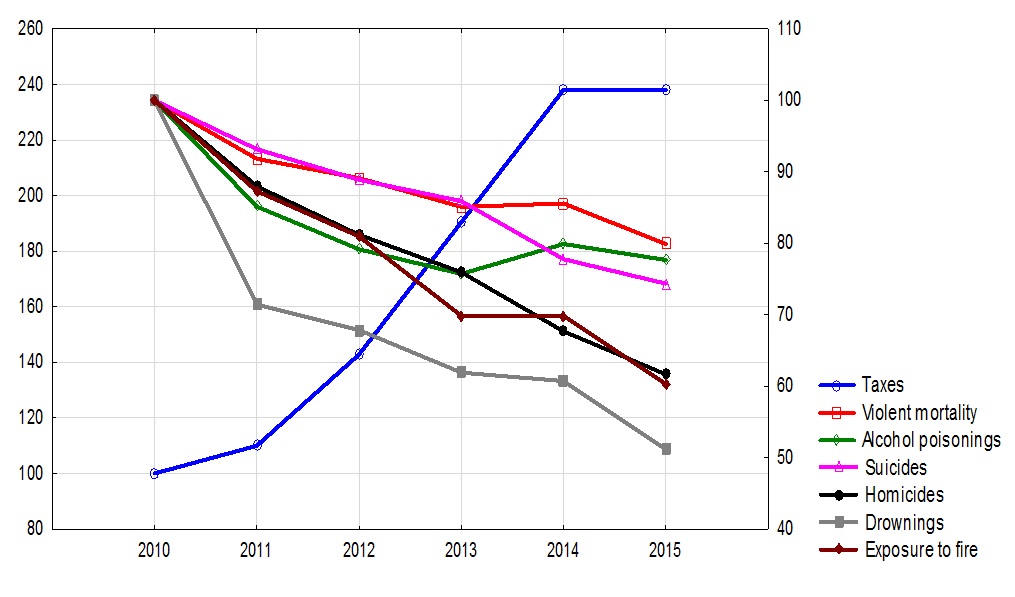

Figure 1: Indices of the excise tax rates on vodka (left scale) and violent mortality rates (right scale) in Russia between 2010 and 2015 (2010-100%).

A Spearman’s correlation analysis suggests a statistically significant inverse relationship between the excise tax rates for vodka and suicides, homicides, accidental drowning, mortality due to exposure to smoke, fire and flames and fatal falls. The relationship between the excise tax rates on vodka and fatal alcohol poisonings, fatal motor road accidents was also negative, but statistically not significant (Table 1).

|

Mortality |

Tax Rates |

|

|

R |

P |

|

|

Violent mortality |

-0.90 |

0.015 |

|

Alcohol poisonings |

-0.67 |

0.150 |

|

Suicides |

-0.99 |

0.000 |

|

Homicides |

-0.99 |

0.000 |

|

Road accidents |

-0.06 |

0.913 |

|

Drowning |

-0.99 |

0.000 |

|

Fatal falls |

-0.87 |

0.025 |

|

Exposure to fire |

-0.96 |

0.003 |

DISCUSSION

The results of the analysis indicate an inverse relationship between the rates of excise tax for vodka and violent mortality rates in Russia at the aggregate level. These results confirmed earlier findings based on Russian data that higher taxes on alcohol are associated with a reduction in alcohol-related harm [16]. In particular, using historical data from tsarist Russia, Norström and Stickley reported that changes in vodka taxes were significantly associated with alcohol-related mortality [17]. Collectively, these findings are consistent with the principle that the increase in taxes on alcohol reduces the alcohol-related mortality [11].

Before discussing the implications of these findings, it is necessary to address the potential limitations of the study. It must be acknowledged that there exist a number of factors that may have affected the outcome but that are not considered in the analysis. In particular, the taxation of alcohol is only one of the factors that can affect alcohol-related harm; and, that there may be multiple confounding factors, including socio-economic and demographic variables. In relation to this, some experts consider that the decline in the level of violent mortality in Russia over the past decade can be attributed to the macroeconomic stabilization and a significant increase in population incomes growth, which coincided with the implementation of alcohol control measures [14]. Further, there may also have been potential problems with the violent mortality data used. An earlier study of violent mortality data from the Soviet period concluded that they were not deliberately falsified in Russia [18]. There was, however, a sharp increase of deaths classified as injury with undetermined intent in Russia in the post-Soviet period [19]. Finally, it might be the case, that effect of alcohol tax policy has been outperformed by the effects of measures to reduce the availability of vodka that has been implemented in Russia over the past decade [13].

In conclusion, the results of this study suggest an inverse aggregate-level relationship between the rates of excise tax on vodka and violent mortality rates in Russia. These findings indicate that increase in excise tax rates for vodka appears to be an effective policy to reduce violent mortality rates in this country. It should be noted, however, that while the tax policy should be welcomed, a sharp increase in consumption of unrecorded alcohol in recent years [20], indicates the danger of using alcohol tax on the alcohol market, which is not fully controlled. This highlights the need to implement a comprehensive alcohol policy that must take into account the consumption of alcohol from illicit sources.

REFERENCES

- Razvodovsky YE (2013) Estimation of the level of alcohol consumption in Russia. ICAP Periodic Review Drinking and Culture 8: 6-

- Razvodovsky YE, Nemtsov AV (2016) Alcohol-related component of the mortality decline in Russia after 2003. The Questions of Narcology 3: 63-70.

- Moskalewicz J, Razvodovsky YE, Wieczorek L (2016) East-west disparities in alcohol-related harm Alkohol a nierówno?ci w zdrowiu mi?dzy Wschodem i Zachodem Europy. Alcoholism and Drug Addiction 29: 209-222.

- Stickley A, Razvodovsky Y (2012) The effects of beverage type on homicide rates in Russia, 1970-2005. Drug Alcohol Rev 3: 257-262.

- Razvodovsky YE (2010) Beverage specific alcohol sale and mortality in Russia. Alcoholism and Psychiatry Research 46.

- Razvodovsky YE (2010) Beverage-specific alcohol sales and violent mortality in Russia. Adicciones 22: 311-31

- Razvodovsky YE (2013) Affordability of alcohol and alcohol-related mortality in Belarus. Adicciones 25: 156-162.

- Razvodovsky YE (2013) Alcohol affordability and epidemiology of alcoholism in Belarus. Alcoholism 49: 29-36.

- Chaloupka FJ, Grossman M, Saffer H (2002) The effects of price on alcohol consumption and alcohol related problems. Alcohol Res Health 26: 22-34.

- Wagenaar AC, Tobler AL, Komro KA (2010) Effects of alcohol tax and price policies on morbidity and mortality: A systematic review. Am J Pub Health 100: 2270-2278.

- Moskalewicz J, Osterberrg E, Razvodovsky YE (2016) Summary In: Moskalewicz J, Osterberg E (eds.). Changes in alcohol affordability and availability. Twenty years of transition in Eastern Europe. Juvenes Print, Naulakatu, Finland. Pg no: 157-

- Levintova M (2007) Russian alcohol policy in the making. Alcohol and Alcoholism 42: 500-505.

- Khalturina D, Korotaev A (2015) Effects of specific alcohol control policy measures on alcohol-related mortality in Russia from 1998 to 2013. Alcohol Alcohol 50: 588-601.

- Nemtsov AV, Razvodovsky YE (2016) Russian alcohol policy in false m Alcohol Alcohol 51: 626-627.

- Razvodovsky YE (2014) Was the mortality decline in Russia attributable to alcohol control policy? J Sociolomics 3: 125.

- Stickley A, Razvodovsky Y, McKee M (2009) Alcohol mortality in Russia: A historical perspective. Public Health 123: 20-26.

- Norström T, Stickley A (2012) Alcohol tax, consumption and mortality in tsarist Russia: Is a public health perspective applicable? Eur J Public Health 23: 340-344.

- Wasserman D, Värnik A (1998) Reliability of statistics on violent death and suicide in the former USSR, 1970-1990. Acta Psychiatr Scand Suppl 394: 34-41.

- Värnik P, Sisask M, Varnik A, Yuryev A, K?lves K, et al. (2010) Massive increase in injury deaths of undermined intent in ex-USSR Baltic and Slavic countries: Hidden suicides? Scand J Public Health 38: 395-403.

- Razvodovsky YE (2017) The effects of alcohol taxation and pricing policies on unrecorded alcohol consumption in Russia. Journal of Alcoholism and Drug Dependence 5: 1-3.

Copyright: © 2018 Yury Evgeny Razvodovsky, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.