Reducing Climate Change Vulnerability in Sub-Saharan Africa Cities: Policy Prospects for Social Innovation and Microfinance

*Corresponding Author(s):

Dumisani ChiramboDepartment Of Civil And Public Law With References To Law Of Europe And The Environment, Brandenburg University Of Technology Cottbus- Senftenberg, Cottbus, Germany

Tel:+49 174 6033672,

Email:sofopportunity@gmail.com

Abstract

Africa might not achieve the Sustainable Development Goals (SDGs) because climate change will exacerbate poverty and inequality in the region. Moreover, many African cities are characterised by poor urban planning, gaps in public services and infrastructure and settlement in hazard-prone areas leading to increased climate change vulnerability as city governments/local governments fail to mainstream climate change mitigation and adaptation into local planning. However, social innovations are practices that bring about changes in attitudes, behaviour, or perceptions, resulting in new social practices, new institutions and new social systems, hence social innovation can potentially enable local governments and city dwellers to correct their structural inequalities and address the issues that exacerbate climate risks.This paper presents an assessment of how social innovation can be used to foster transformative adaptation in cities and promote new social practices that can enhance climate change resilience in SSA cities. The methodology for the paper included analyses of research articles, case studies and policy briefs on climate finance disbursements and the implementation of sub-national climate change policies. The paper highlights that SSA cities have many entrepreneurs that can provide services to enhance climate change resilience but they are marginalised due to inappropriate regulatory systems. Consequently, policies that promote microfinance and social innovation have the potential to reduce climate change vulnerability in cities by improving climate finance flows to local non-state actors and small businesses in the informal sector.

Keywords

Climate finance; Corporate Social Responsibility (CSR); Diaspora; Informality; Sustainable Development Goals (SDGs); Urbanisation

INTRODUCTION

The Sustainable Development Goals (SDGs) are calling for policy-makers and non-state actors to put in place policies and strategies that can eliminate poverty; reduce inequality;integrate climate change measures into national policies, strategies and planning; and support poor countriesto reach the SDG target 8.1 of sustaining per capita economic growth in accordance with national circumstances and, in particular, at least 7% Gross Domestic Product (GDP) growth per annum in the least developed countries [1]. However, achieving these goals might prove to be unsurmountable particularly in the case of Africa. This follows that while extreme poverty rates have fallen in every developing region in the world, in Africa, excluding North Africa, poverty remains most widespread and the number of Africans (excluding North Africans) living below the poverty line rose from 290 million in 1990 to 414 million in 2010 [2]. The World Bank has therefore asserted that achieving the SDGs and eradicating poverty by 2030 will be aspirational and feasible only under very optimistic of scenarios, more particularly for Africa- which is forecasted to continue to have the highest rate and depth of poverty of all regions of the world beyond 2030 [3]. Additionally, despite the presence of many regional and national climate change programmes and policies, climate change impacts are still noted to be exacerbating poverty, engendering food insecurity and perpetuating migrations and social conflicts. Consequently, the 2015/16 climate change induced drought that occurred in Southern Africa is estimated to have instigated maize declines that ultimately reduced GDP in the Southern African Development Community (SADC) area by 0.1 percentage point and increased poverty by 1.4 million people [4]. It can therefore be argued that Africa is in need of new innovative policies and development paradigms that can simultaneously address its climate change and poverty challenges in order to enable the continent to achieve the SDGs.

Social innovations are practices that bring about changes in attitudes, behaviour, or perceptions, resulting in new social practices and/or are practices that bring about changes in the way social agents act and interact with each other [5]. In other contexts, social innovations are new solutions (products, services, models, markets, processes, etc.) that simultaneously meet a social need (more effectively than existing solutions) and lead to new or improved capabilities and relationships and better use of assets and resources [6]. In rural Tanzania, social innovation was highlighted as a strategy that could improve climate change adaptation by enabling informal civic institutions to collaborate with local government authorities and state courts in order to improve the livelihoods of people in communities [7]. In the European context, social innovation was noted to be successful in revitalising rural livelihoods by improving local service delivery in rural areas and empowering vulnerable groups [8,9] In the case of cities in Sub-Saharan Africa (SSA), limited access to financial resources, information (e.g. weather forecasts and flood early-warning data) and social networks are aspects that constrain SSA urban communities from accessing new technologies and making proactive investments in measures that can reduce their exposure to climate risks [10,11]. It can therefore be hypothesised that social innovation can potentially improve the collaboration between local governments and urban communities in order to improve service delivery, environmental governance and climate change resilience.

Previous studies on social innovation, urbanisation and climate change vulnerability in urban SSA include Cobbinah et al. [12], who assessed the implications of rapid urbanisation on the sustainable development of Africa. Cobbinah et al. [12], discovered that urbanisation has multifaceted causes - such as natural population growth; increasing insecurity and conflict; and pull factors (e.g. uneven spatial development of urban and rural areas, perceived economic opportunities in cities) and push factors (e.g. unprofitable agriculture, drought, limited livelihood options in rural areas). They also discovered that there was very limited meaningful guidance available to African governments, planning institutions and policy makers regarding how best to address these concerns. Angelidoua and Psaltoglou [6] examined how social innovation fits in the urban sustainability discourse and in what way it empowers urban citizens and their communities towards serving their interests. Angelidoua and Psaltoglou [6] discovered that social innovation initiatives focused on the circular and/or sharing economy may lead to the creation of innovative business models and social enterprises, which in turn may be backed by or result to the creation of communities and networks of people who share common goals and concerns. Brown and McGranahan [13] examined the opportunities and barriers that the urban informal economy pose for making economies greener and the risks that attempts to create green economies pose for vulnerable informal dwellers and workers. Brown and McGranahan [13] argued that the green economy agenda mustengage constructively with the urban informal economy if it is to have any meaningful impact on the transition to an economy that is not only greener, but also inclusive of disadvantaged women and men.Notwithstanding the aforementioned studies, there are still knowledge gaps regarding how social innovation can be used to reduce climate risks by augmenting climate finance for enhanced climate change governance and resilience in SSA cities.

To address theknowledge gaps on the influence that social innovation could have in reducing climate risks in SSA cities, an inductive inquiry based on an analysis of research articles, case inpoints, project reports and policy briefs on climate finance to SSA and the development and implementation of sub-national climate change policies in the context of SSA was undertaken.The next section provides a synopsis of how the high rates of urbanisation in Africa could leadto environmental degradation and increased climate change vulnerability in African cities. Section three provides an analysis of how climate finance modalities can be enhanced in order to promote climate change resilience in African cities; and how diaspora funds and Corporate Social Responsibly (CSR) activities may be used to support the implementation of urban climate change policies. Section four highlights the need to adapt and create new microfinance models in order to improve the mobilisation of climate finance from various sources and improve the disbursement of climate finance to local level actors and marginalised sectors. The discussion in section five focuses on the various roles to which South-South Climate Finance (SSCF) modalities can be harnessed in order to facilitate the implementation of SDG 11 (Make cities and human settlements inclusive, safe, resilient and sustainable). Lastly, the conclusion in section six highlights why developed country city climate change strategies may not be directly transposed and applicable in developing countries, hence the need for African cities to develop new urban development paradigms that include social innovation as a means for ensuring that inclusive growth and climate change resilience can be attained in African cities.

ADAPTING URBAN PROCESSES AND PRACTICES TO REDUCE ENVIRONMENTAL DEGRADATION AND CLIMATE CHANGE VULNERABILITY IN AFRICAN CITIES

Africa’s population is set to more than double by 2050 to almost 2.5 billion hence the continent will eventually be home to 25% of the world’s projected population [14]. Africa has a 37% urban population rate and is a region that is currently experiencing the highest rate of urbanisation at approximately 4% per annum [15]. Africa’s urban population is also projected to increase from about 409 million in 2010 to approximately 1,364 million in 2050 [16]. However, many African cities and city governments/local governments fail to mainstream climate change mitigation and adaptation into local planning hence many African cities are characterised by poor urban planning, land and water pollution, gaps in public services and infrastructure and settlement in hazard-prone areas [17,18]. Unfortunately, much of the urban population growth occurring across Africa is taking place in slums and informal settlements and will continue to do so for the foreseeable future - a pattern sometimes referred to as the urbanisation of poverty [19]. Moreover, the high rates of urbanisation to slum areas has also meant that 54% of all employment in Africa emanates from the informal economy in comparison to only 3% of employment being in the informal economy in Highly Industrialized Countries [20]. Consequently, there is a threat that increased urbanisation rates in Africa could increase climate change vulnerability and poverty in the region; and that the urban climate risk mitigation measures adopted in developed country cities might not necessarily be successful when deployed in developing country cities due to differences in factors influencing vulnerability in developed and developing countries.

Some researchers have pointed out that reducing vulnerability to climatic variability and change in developing countries will necessitate the need for institutionsto adjust their practices, processes, legislation, regulations and incentives in order to mandate or facilitate changes in socio-economic systems and that adaptation policies need to transition from one-dimensional technocratic solutions that ignore the drivers of local vulnerability to new paradigms that change the conditions that create vulnerability in the first place [21,22]. Additionally, for African cities to be sustainable and inclusive, policy makers will need to think differently about how spatial planning, regulation, economic growth, infrastructure and public services can be delivered to support informal settlements, livelihood systems and local economies in African cities [19]. This arguably means that enhancing climate change resilience and promoting sustainable development in African cities will encompass the need for non-state actors to support local governments in sectors and resources that local authorities lack. This could therefore enable cities to be empowered to develop climate resilient local infrastructure and public service delivery systems and develop and regulate inclusive local laws related to land use and building standards.

For example, even though the solid waste generated in cities can be used to generate renewable energy and promote climate change mitigation [23,24], many African cities lack sound municipal solid waste management systems due to challenges in the collection, transportation, disposal and treatment of waste [15]. However, the experience in Bogota [25], demonstrates that the private sector and informal workers have the potential to undertake some waste management roles in cities thereby enabling cities to save on costs and resources by offsetting costs related to constructing or rehabilitating some infrastructure. In the case of Bogota, the City officially recognised the city’s waste pickers and included them in the city’s recycling and waste management processes thereby creating an income for the waste pickers and making the amalgamation of waste for recycling, re-use and energy production easier [25]. Similarly, it can be argued that there is potential that should African cities foster institutional and social innovation (rather than only focusing on how to acquire new technologies) and therefore change some of their processes and operations so as to include the private sector and people in the informal sector for service provision, effective climate change resilience may be achieved even within the context of cities having scarce resources.

ADDRESSING CLIMATE FINANCE CHALLENGES FOR SSA AND AFRICAN CITIES

The climate change adaptation finance gap for African cities

The global framework for managing the impacts of climate change as represented in the Nationally Determined Contributions (NDCs) submitted to the United Nations Framework Convention on Climate Change (UNFCCC) shows that the current ambition of NDCs falls far short of reaching any of the goals in the Paris Agreement and the global goal to limit temperature increase to 2°C [26-28]. This therefore means that atmospheric greenhouse gas emission concentrations will not only increase to dangerous levels, but it will also mean that the costs for climate change adaptation will continue to rise [29]. Consequently, between now and 2030, climate policies and stringent global emissions reductions can do little to alter the amount of global warming that will take place and as such a plausible option therefore, is to reduce vulnerability and poverty through targeted adaptationinvestments and improved socioeconomic conditions(higher incomes and lower poverty and inequality)[30,31].

However, promoting investments in climate change adaptation programmes and infrastructure faces a myriad of challenges in Africa. For example, climate finance flows reached a record highof US$437 billion dollars in 2015, followed by a 12% drop in 2016 to US$383 billion; and the global allocation of climate funds in 2015 and 2016 stood at around US$409 billion/year whereby public finance actors and intermediaries committed an average of US$139 billion/year or 34% of total climate finance flows and private climate finance averaged US$270 billion/year) [32]. From this amount it was estimated that SSA received US$12 billion, Middle East and North Africa received US$8 billion and East Asia and Pacific US$132 billion [32]. On the other hand, the already precarious situation with the insufficient amounts of climate finance being available for Africa might even become more precarious as the United States of America plans to withdrawal from the Paris Agreement, and with this withdrawal, there could be a fall of US$2 billion, or 20% of pledged finance to the Green Climate Fund that would have otherwise deployed much needed grants, equity, concessional loans, and risk mitigation instruments to scale-up private finance in developing countries [32].

An analysis of climate finance disbursements further shows that African cities might not be receiving climate funds that are commensurate to their vulnerability. For example, approximately 75% of global economic output currently comes from cities [33] but in spite of increasing urbanisation and increasing vulnerability in cities,multilateral climate funds in the period 2010-2014 to support lowemissionand climate resilient development in developing country cities provided about US$842 million in approved climate finance for explicitly urban projects, which equates to just over one in every ten dollars spent on climate finance over these five years [34]. This therefore reinforces the notion of Yu [35] that the levels of climate finance provided to Africa are generally far from satisfactory in terms of the size, source and distribution.

The diaspora and remittances as sources of adaptation finance for African cities

Some estimates point out that Africa’s diaspora and migrants provide around US$40 billion a year in officially recorded remittances in addition to having US$50 billion in diaspora savings that could be leveraged for low-cost project finance and having the potential to provide more than US$100 billion a year to help develop Africa [36,37]. Since the levels of remittances to Africa are increasing, there is potential for remittances to be used asa development tool that can be leveraged with other sources of financing to facilitate the provision of economic, human capital and social safety nets for poor families [38]. In their assessment, Castello and Boike [38] discovered that remittances have increased ten-fold over a period of ten years and small developing countries received over 18% of the total remittances in that time, with remittances growing to nearly 50% of GDP within certain countries.

In Zimbabwe, the private sector has displayed signs of acknowledging that the diaspora can play an important role in promoting investments and infrastructure development in a country. As a case in point, Zimbabwean diaspora in South Africa established the Diaspora Infrastructure Development Group. The Diaspora Infrastructure Development Group is an investment holding company that works with the Government of Zimbabwe and other key institutions in order to increase financial flows into Zimbabwe through the aggregation of individual investments and funds from the large Zimbabwean diaspora contingent [39]. Some of the notable infrastructure development achievements that the Diaspora Infrastructure Development Group has been involved in include being part of a consortium to provide US$400 million for the recapitalisation of the National Railways of Zimbabwe (NRZ) [40]. In this scenario, the investment was done through national government mechanisms, but however, it might be argued that this scenario also demonstrates that there is potential that if cities are proactiveby engaging and partnering with diaspora investment groups directly, they can potentially attract diaspora investments to the city’s key infrastructural needs which can also be vital infrastructure related to enhancing climate change resilience.

Mobilising adaptation finance for SSA cities through Corporate Social Responsibilities (CSR)

Some studies on climate change governance highlight that CSR and corporate codes of conduct can lead to transformations in climate change governance by regulating the emission of greenhouse gases from the private sector and promoting the use of market-based mechanisms to combat climate change [41]. However, with the realisation that many environmental and climate change programmes and activities are constrained by financial shortfalls, there is a need for various stakeholders to explore how funds for climate change activities may be effectively mobilised and disbursed through CSR channels in order to enhance climate change resilience in cities. In this regard, it might be argued that by city governments improving their articulation of climate change policies and ambitions to the private sector, there could be potential to increase financial and technical assistance from the private sector to cities. As a case in point, in India, section 135 of the Indian Companies Act 2013, mandates businesses with annual revenues of over 10 billion rupees (US$156 million) to spend 2% of their average net profits on CSR activities [42,43]. Some reports have noted that the private sector charitable spend on social activities in sectors such as education, health and poverty alleviation increased from 33.67 billion Rupees (US$524 million) in 2013 to around 250 billion Rupees (US$3.89 billion) after the enactment of the Act [44]. Arguably, the provision of mandatory obligations for certain companies ensures that there is a predictable amount of finance available through the private sector to complement public finance and resources for improved social services delivery. Similarly, city policymakers in SSA can engage with the private sector in their jurisdictions to set-up frameworks that can incentivise or mandate companies that generate revenues above a certain threshold to contribute a certain percentage of their net profit towards well planned and coordinated climate change programmes and activities that are in keeping with the cities’ climate change ambitions. Alternatively, the funds raised through such a strategy may also be used to support the development of social entrepreneurs and promote climate change entrepreneurshipsince entrepreneurship can facilitate the attainment of the SDGs in SSA and may be an alternative to unemployment and poverty hence becoming the panacea for development [45,46]. As it stands, social entrepreneurship and social enterprises in Africa operate in a constrained environment due to institutional voids and market inefficiencies [47]. However, by more funds being mobilised to improve the environment for climate change entrepreneurship or CSR activities supporting the establishment of Climate Innovation Centres [48,49], there is potential that the entrepreneurs in SSA could take a commanding role in undertaking activities that can successfully promote climate change mitigation and adaptation (e.g. waste management, urban and peri-urban agriculture (UPA), renewable energy technologies sales, etc.).

ADAPTING MICROFINANCE MODELS FOR IMPROVED ENVIRONMENTAL AND CLIMATE CHANGE GOVERNANCE IN AFRICAN CITIES

Some reports indicate that most Africans are disconnected from the formal financial system as over two-thirds of the adult population of Africa - 316 million people – have no bank account and fewer than 15% of the adults in Africa have accounts at a formal financial institution [50]. Africa’s low levels of financial inclusion is therefore often cited as an aspect that constrains development in Africa since the provision of financial services and credit plays a vital role in unlocking productivity gains and expanding markets and enabling people to invest in their homes [50]. Additionally, low levels of financial inclusion also exacerbate climate change vulnerability since it limits the abilities of businesses and households to save money; utilise risk transfer mechanisms, such as insurance; and access credit facilities which can enable them to buy technologies that can help with their efforts to mitigate and adapt to climate change [51-54]. Arguably, the development of financing mechanisms that can simultaneously increase financial inclusion and improve climate risk management in African cities may therefore have a significant impact in ensuring that the resilience of households in African cities is enhanced.

According to Soanes et al. [55], there is no definitive understanding of the amount of climate or development finance that reaches local actors but it might be assumed that between 2003 and 2016 the approximate amount of climate finance from international, regional and national climate funds channelled to local climate activities was below 10% (US$1.5 billion). This arguably demonstrates that there is still a need to improve financial intermediation in order to bridge the gap between the disbursement of climate finance at international level and the large number of small transactions and activities that are required at local level [34]. In this regard, it might be argued that microfinance can play a significant role in being such a climate finance intermediary. Microfinance is regarded as a dynamic development tool that can empower Base of Pyramid (BOP) entrepreneurs and reduce (rural and urban) poverty, as in contrast to conventional development aid, microfinance involves and often even focuses on the informal sector (including those in slum areas) and may be an alternative to macro-economic solutions that are often used in development aid programmes [56]. The other notable attributes of microfinance in SSA include its potential to increase incomes, savings, expenditure and the accumulation of assets; improving health and nutrition; improving food security; promoting women’s empowerment; improving job creation; and promoting social cohesion [57]. Additionally, microfinance is also used to support the recovery of communities that have been impacted by natural disasterssuxh as droughts and floods [58]. More importantly, it has been suggested that climate change might increase insecurity, conflicts and political instability in Africa due to heightened conflict over resources and increased movements of people [59]. In this regard, microfinance could also be a valuable development mechanism as microfinance programmes have the potential to be used as mechanisms to revive economies and support the growth of businessesin conflict and post-conflict situations [60]. The scope for microfinance in supporting sustainable development in African cities therefore transcends from improving livelihoods, to enhancing climate change resilience, to enabling communities to recover quickly after climate related economic, social and environmental shocks.

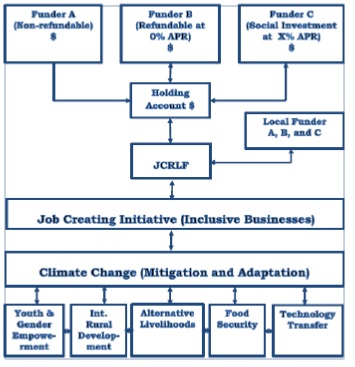

Microfinance could be presented as a development tool that can reduce climate change vulnerability in different urban contexts due to its potential to reduce poverty and empower women. However, for microfinance modalities to further enhance or augment climate change mitigation and adaptation activities, there will be a need for microfinance models to be adapted in order to address the challenges exhibited in some urban climate change programmes and policies and to address the current and future vulnerabilities of inhabitants and businesses in African cities. According to Van Rooyen et al. [57] and Rippey [61], microfinance institutions and microfinance models vary in their mission, financial resources and target market hence different microfinance institutions and microfinance models produce different socio-economic impacts on stakeholders, beneficiaries and localities. Moreover, other microfinance models are donor dependent whilst others are commercial-viability orientated and this affects the sustainability, impact and outreach of microfinance institutions [62-64]. An example of a microfinance model/framework that has been developed or adapted specifically to respond to the threats of climate change is the Microfinance-Inclusive Growth Framework (Figure 1).

As depicted on figure 1, the model demonstrates how microfinance institutions can simultaneously mobilise technical and financial resources from private, philanthropic and public resources (i.e. Funder A may be individuals, investors, governmentagencies, private enterprises and non-governmental organisations that make a philanthropic donation or fee-free support to a microfinance institution. Funder B may be individuals, investors, government agencies, private enterprises and non-governmental organisations that provide a refundable donation or an interest free loan to a microfinance institution. Funder C may be individuals, investors, government agencies, private enterprises and non-governmental organisations that provide concessional loans to microfinance institutions.).

Since the model/framework works on the premise that a microfinance institution pools or blends finances from divergent sources (i.e. private, philanthropic and public resources) rather than depending on one source of finance, it manages to address three challenges associated with climate finance, that is (i) Increasing the amount/value of resources for climate finance, (ii) Mobilising sufficient climate funds to increase the outreach and accessibility of climate finance mechanisms and (iii) Enabling climate finance to be accessible and affordable to local level beneficiaries/clients. This approach therefore demonstrates that by blending and pooling finance from commercial and non-commercial sources, microfinance institutions can provide capacity building services and provide credit at low interest rates, offer long grace periods and provide grants, hence minimising the adverse impacts that high interest rates have on the development and impact of social entrepreneurship and utilisation of financial products in Africa. More importantly, it has been suggested that the cost of adaptation in developing countries including countries in Africa is estimated to be between US$280 and US$500 billion per year by 2050, suggesting that the cost of adaptation in Africa may rise above US$100 billion per year by 2050, hence even though adaptation finance through the UNFCCC will help offset some of these costs, it is not of the magnitude required for climate proofing [65]. Therefore, the possibility of microfinance institutions to use models/frameworkthat emphasise on pooling and blending finance from various resources may not only enhance the roles of microfinance institutions as versatile intermediaries to mobilise and disburse climate funds but can also help in leveraging and attracting private finance into the climate finance domain to reduce adaptation funding gaps.

Note: The framework was nominated for the UNDP MDG Carbon/Mitsubishi UFJ Morgan Stanley Securities 2014 Climate Finance Innovation Award; JCRLF denotes a microfinance institution or revolving fund within a microfinance institution.

Figure 1: Microfinance-inclusive growth framework (Job Creation Revolving Loan Fund (JCRLF)).

Source: Chirambo [66].

The sectors/activities are:Climate change impacts cannot be neatly separated from the other pressures that have a bearing on the viability of poor urban African household budgets and planning and undertaking ‘climate compatible development’ in African cities must accommodate this reality, accounting for a broader set of interconnected vulnerabilities and development priorities [19]. Consequently, the Microfinance-Inclusive Growth Framework also incorporates five sectors/activities which influence economic development and climate change vulnerability in SSA. The framework therefore demonstratesthe sectors/activities to which microfinance institutions aiming to promote climate change mitigation and adaptation can focus on.

The sectors/activities are:

- Food Security: Increasing agricultural production canreduce vulnerability to climate change by ensuring food security and high incomes for a multitude of Africans. However, agricultural loans made by banks usually represent less than 5-10% of their total portfolios and social lenders and domestic alternative sources satisfy less than 2% of the non-commercial farmers’ finance demand [54]. There is therefore a need for financial service providers to increase financing towards agriculture production in both rural and urban SSA.

- Technology Transfers and Diffusion: SSA needs to enhance its deployment of irrigation technologies and renewable energy technologies in order to achieve its NDCs [67,68]. However, since a lack of credit facilities limits enterprise development and investments in new technologies [50,69], there is therefore a need for financial service providers to provide innovative financial products that can make new technologies more affordable or available on credit.

- Alternative Livelihoods: Reducing the dependence of SSA livelihoods on the agriculture sector can enhance climate change resilience in the region [70,71]. However, since the availability and cost of finance is one of the main constraints to entrepreneurs, small enterprises and social enterprises developing non-agriculture jobs and services [72,73], there is therefore a need for financial service providers to provide a broad range of financial products that can support social enterprises to create jobs and provide essential services in slums and other marginalised areas. For example, providing training and investments in a mix of low- and high-tech solutions (e.g. biogas digesters, low-flow solar water heaters, wind pumps, floating classrooms, plastics recycling, composting toilets, etc.) can guarantee affordability and universal access to technologies whilst creating local jobs in the production, installation and maintenance of the technologies [19].

- Integrated Rural Development: Despite high rates of migration to urban areas, most SSA youth continue to reside in rural areas and will continue to do so over the coming years to the extent that SSA is the only region where the rural population is continuing to grow in absolute terms [74]. There is therefore a need for financial service providers to provide financial products to urban enterprises that support rural entrepreneurship and/or have direct linkages to rural enterprises to facilitate integrated rural development.

- Women and youth empowerment: Women and the youth are marginalised when it comes to accessing jobs and owning and controlling productive resources (including climate finance) in SSA [75,76]. Consequently, SDG 1.4 advocates for increased and equal access to financial services including microfinance to vulnerable and marginalised people in communities. Microfinance institutions in SSA can therefore play a vital role in ensuring that SDG 1.4 is achieved by providing bespoke financial products that can enable women and youth to establish inclusive enterprises and acquire productive resources in their community.

Microfinance institutions, households, social enterprises, informal enterprises and city governments/local authorities are distinct entities that are influenced by climate change impacts differently and they can also augment climate change mitigation and adaptation differently. Social innovation will arguably be important to promote multi-sectoral dialogue between these stakeholders and to ensure that the aforementioned stakeholders can work together in developing city climate change policies and programmes and improving the coordination and implementation of planned programmes and activities. This follows that in the current status quo- where city policies seem to have a focus on disrupting informal settlements and businesses hence undermining the potential of informal activities to improve the adaptation of cities to climate change [77,78] city planners arguably do not consult people in the informal sector when developing city climate change policies and programmes. On the other hand, incorporating the opinions of local microfinance institutions when developing city climate change policies and programmes can not only enable the city to determine which incentives the city can provide to microfinance institutions to motivate them to provide financial products and services that can assist in facilitating the delivery ofcity climate change programmes but it may also enablethe city policy makers to take a leading role in collaborating and strategising with local microfinance institutions on how to access national and international climate funds.

DISCUSSION

Some projections indicate that by 2050 global urban population will exceed 6.7 billion and that nearly 80% of population growth will take place in low and middle income countries, where populations are already rising by over one million people per week [33]. This means that by 2050 there will be 2.1 billion more people living in Asian and African cities [34]. Unfortunately, even new town building as an urbanisation strategy in Africa has proven to be ineffective as both old and new cities in Africa are exhibiting signs of being unable address contemporary urban challenges such as rapid urbanisation, informality, social exclusion, economic development, urban sustainability, as well as climate and environmental change [77,79]. It might therefore be argued that attaining SDG 11 (make cities and human settlements inclusive, safe, resilient and sustainable) will require more consideration of the factors perpetuating climate change vulnerability in cities and improving the collaboration of urban policymakers, global policy makers and non-state actors to improve the provision of services and infrastructure more particularly in informal settlements where a majority of the growth and climate change vulnerability is anticipated.

Improving the mobilisation and delivery of climate finance at national and sub-national level in SSA is vital to facilitate the effective implementation of the various climate change programmes and policies that are in existence and also to enable project developers to have additional sources of finance to leverage and use to improve the provision of services and infrastructure more particularly in informal settlements. However, there is a mismatch between climate funds pledges and the financing costs for developing low-carbon climate resilient societies in Africa which are estimated to be up to US$675 billion per year [32,35,80,81]. Additionally, although city mitigation and adaptation efforts must largely be planned, implemented and managed locally, the climate finance system has primarily channelled money for urban projects to (or through) national governments [34]. This arguably implies that Africa requires more innovation in the way that it plans and finances development and climate change programmes.With the aforementioned factors in mind, some researchers have argued that African nations need to reduce their dependence on donors and Official Development Assistance (ODA) for financing development and climate change programmes since these sources of finance depend on the priorities and (economic and political) circumstances of the donor countries rather than the needs and priorities of the recipient countries [82,83]. Indeed, progress on some of the Millennium Development Goals (MDGs) in Africa lagged as a consequence of several ODA commitments to Africa not being fulfilled, leading to some commentators to highlight that a more sustainable way to finance development in Africa would be for governments to focus on creating financing models and channels that integrate development assistance/public financing with private sector finance and improving the mobilisation of domestic resources [84].

Similarly, research undertaken by Sireh-Jallow [85] showed that even though Africa has various sources of non-traditional development finance mechanisms to replace and/or compliment ODA (i.e. diaspora bonds, carbon sequestration and trading, renewable energy, Islamic finance, etc.), many African countries do not use such measures to finance development.For example, the Government of Ethiopiaissued the Renaissance Dam Bond in order to mobilise approximately US$6.4 billion for the construction of the Grand Ethiopian Renaissance Dam. The Grand Ethiopian Renaissance Dam Project is a 5,000 Megawatts renewable energy project with significant climate change mitigation potentialand climate change adaptation potential by facilitating industrialisation and enabling the country to earn income through electricity trading [85]. However, not many African countries have taken a similar route to use diaspora bonds for infrastructure development.

Arguably, in the climate finance arena too, there is a dependence of African governments to depend on climate change financing commitments and climate finance modalities established by the global community in order to support national governments in fulfilling their climate change obligations [29,68]. For example, the full implementation of the NDCs for Uganda is contingent upon the country sourcing up to 70% of the required resources from external sources [86]. This scenario therefore means that both cities and national governments are constrained of climate finance to facilitate their projects when external support is not forth coming.

One possible way to improve innovation and capacity building on local level/city level climate finance resource mobilisation and local level engagement of private capital mobilisation for development finance and climate financingwould is to utilise South-South Climate Finance (SSCF) modalities as a means to build the capacity of local authorities (and other local level stakeholders) to develop climate change projects. Traditionally, most climate finance has been mobilised and disbursed by Global North stakeholders to stakeholders in the Global South. However, in the existing status quo, it has been observed thatclimate finance is struggling to reach the local level because (i) There is limited support to build local capacity meaning that only afew climate funds provide capacity support for building local capacity and those that do seldom allow sufficient timeto build the skills needed; and (ii) Traditional financing intermediaries for climate funds such as multilateraldevelopment banks, are less able to finance small-scale projects directly, given the higher transaction costs [55]. However, there is now evidence to suggest that there will be increased funding to Africa from members of the Global South through SSCF modalities [37]. For example, during 2015/2016 approximately US$8 billion of climate finance flowed between different developing countries [32] and China’s NDC incorporates a pledge to provide US$3.1 billion (CNY20 billion) to establish the China South-South Climate Cooperation Fund for Climate Change, which is in addition to more than US$2 billion that was already pledged for South-South Cooperation and climate-related activities before 2015 [87,88]. Therefore rather than focusing on just implementing new infrastructure projects with the additional resources from the new SSCF modalities, there should be a greater focus on SSCF modalities to develop the capacities of cities to implement climate finance projects as that will also lead to cities being able to access and attract more funding to the cities autonomously.

Equally important, is the need to also use SSCF to build the capacity of non-state actors and project developers to scale-up and replicate the successful interventions or models for mobilising climate finance at local level and in cities. This can be particularly important as despite the existence of numerous non-traditional development finance mechanisms that African governments can use to promote development, some African governments have not been able to learn or build capacity from the countries that have used such non-traditional development finance mechanisms [85], possibly because of a lack of additional financial resources or an institutional set-up to facilitate the diffusion and dissemination of such knowledge and processes.

Lastly, Africa is one of the most vulnerable regions to the impacts of climate change not only because of funding gaps for climate change programmes but also because of governance challenges. In this regard, weak governance institutions, partisan politics, lack of political will and systemic corruption hamper efforts to transition African countries towards climate resilient development [89]. Therefore, from one perspective it might be argued that social innovation and new social practices might not be sufficient modalities for reducing climate change vulnerability. However, some research points out that climate change adaptation has the potential to address some of the mistakes and shortcomings of conventional social and economic development pathways that have contributed to poverty, misgovernance, environmental degradation and gender inequality [21]. Additionally, research by Filho et al. [90,91], proposed that unlike developed countries, developing countries need to implement transformational climate change policies. In the context of that research, it was stated that transformative climate change adaptation processes were processes which went beyond the conventional adaptation through physical changes (e.g. higher ?ood barriers) and moved towards building resilience. Some of the characteristic key features of transformative climate change adaptation approaches were given as: A) They help to enhance resilience, b) They help to promote sustainability, c) They help to reduce vulnerability, d) They take into account the risks in implementation and e) They pay due attention to the socio-economic (and political) contexts of a given community. These issues therefore suggest that the most appropriate adaptation for African countries is transformative climate change adaptation and that the successful implementation of transformative climate change adaptation can partly address Africa’s corruption and misgovernance challenges be it through bottom-up approaches.

CONCLUSION

Even though different African countries have divergent socio-economic profiles and development strategies, they mostly share similarities in having high urbanisation rates and increasing rates of climate change vulnerability. Factors such as ineffective governance structure and a seemingly lack of resources to enable the city authorities to provide infrastructure and services especially in informal settlements continue to hamper the progress to which SSA cities can be considered inclusive. Additionally, climate change is also adding new strains on city resources as developing climate change resilient infrastructure and services would require African countries to mobilise up to US$675 billion per year. Regardless of these technical and financial challenges, there are numerous possibilities that climate finance may be utilised to simultaneously enhance the resilience of cities to climate change and to be leveraged with other sources of finance to create new infrastructure and services for cities. For this to occur, rather than using the emerging SSCF modalities for procuring new technologies and developing hard infrastructure, African city authorities should consider using SSCF modalities as a means for mostly improving the human capacity of local city planners and city policy makers to (i) Improve their understanding of their local climate risks and vulnerabilities and (ii) Improve their skills in developing climate finance projects. Arguably, with enhanced local capacity and knowledge on climate change issues, the higher the probability that local city authorities will be able to attract more financing from climate finance and non-conventional financing since a contributing factor to the inability of cities to attract climate finance has been the lack of institutional capacity at city level do develop and implement bankable projects.

The divergent growth patterns of various African cities where most of the growth isoccurring in informal settlements is noted to be perpetuating the urbanisation of poverty, environmental degradation and climate change vulnerability. Moreover, there are very high levels of informality in SSA and very low levels of informality in developed countries implying that developed country city climate change strategies may not be directly transposed and applicable in developing countries and that the approaches for delivering climate finance to the most marginalised and vulnerable communities in developing countries has to be different than from a developed country. On the other hand, the importance of micro and small businesses to the GDP of many African countries and their potential to provide essential services in cities in post-conflict circumstances or after extreme weather shocks should also not be ignored as they can augment or replace services provided by public utilities, hence increasing the climate change resilience of cities. Consequently, these issues bring to prominence how microfinance can be used to blend or pool different sources of finance in order to have the dual role of improving the mobilisation and disbursement of climate finance and improving the accessibility of climate finance at local level, especially to support the most marginalised and vulnerable sectors such as women, the youth and urban and peri-urban agriculturists.

Integrating the aspirations of SDG 11 and SDG 13 (take urgent action to combat climate change and its impacts) in the context of African cities will require new urban development paradigms to ensure that the multitude of people and livelihood systems that depend on the informal economy can contribute to inclusive socio-economic development. Arguably, fostering inclusive socio-economic development can greatly be aided should cities embrace social innovation as a means to have multi-sectoral dialogues with various stakeholders in cities during the planning and implementation of climate change policies and programmes. Through social innovation, aspects associated with informality such unregulated trade and service provision and settlement on unplanned land without public services will have to be considered from the perspective of improving their status so that they can reduce the vulnerability of those that depend on them, as well as from the perspective of ensuring that aspects associated with informality are provided with sufficient support to facilitate their adaptation to the changing threats and risks that current and future climate change will bring. Social innovation can also enable cities to be able utilise bottom-up approaches for mobilising resources for climate change programmes by enabling the cities to tap into the numerous underutilised sources of finance and non-conventional development finance. This follows that in the current status quo, city governments share similarities with national governments whereby they have both been slow to recognise how non-conventional sources of finance such as CSR and diaspora savings can be leveraged with climate finance and other forms of development finance in order to create cities that are both inclusive and climate resilient. However, with a better engagement and collaboration between city authorities and the private sector, CSR activities and resources mobilised from diaspora investment groups can be directed towards city climate change programmes. So, even though there are seemingly insufficient amounts of climate finance for urban projects being provided to African cities through international climate finance modalities, by African city makers looking within and locally, they might discover that they have numerous local untapped resources to support the development and implementation of effective environmental and climate change policies and programmes.

REFERENCES

- UN (2015) Transforming our world: The 2030 agenda for sustainable development. United Nations, New York, USA.

- UNECA (2014) Assessing progress in Africa toward the millennium development goals: MDG Report 2014- analysis of the common African position on the post-2015 development agenda. United Nations Economic Commission for Africa, Addis Ababa, Ethiopia.

- TWB (2015) Africa's Pulse. The World Bank, Washington, DC., USA.

- TWB (2017) Africa’s Pulse: An analysis of issues shaping Africa’s economic future. The World Bank, Washington DC., USA.

- Cajaiba-Santana G (2014) Social innovation: Moving the field forward. A conceptual framework. Technological Forecasting and Social Change 82: 42-51.

- Angelidoua M, Psaltoglou A (2017) An empirical investigation of social innovation initiatives for sustainable urban development. Sustainable Cities and Society 33: 113-125.

- Rodima-Taylor D (2012) Social innovation and climate adaptation: Local collective action in diversifying Tanzania. Applied Geography 33: 128-134.

- Lindberg M (2017) Promoting and sustaining rural social innovation. European Public & Social Innovation Review, Luleå, Sweden.

- SEMPRE (2017) About the Social Empowerment in Rural Areas Project. Social Empowerment in Rural Areas, Rendsburg, Germany.

- Bryan E, Ringler C, Okoba B, Roncoli C, Silvestri S, et al. (2013) Adapting agriculture to climate change in Kenya: Household strategies and Determinants. Journal of Environmental Management 114: 26-35.

- Huang J, Wang Y (2014) Financing sustainable agriculture under climate change. Journal of Integrative Agriculture 13: 698-712.

- Cobbinah PB, Erdiaw-Kwasie MO, Amoateng P (2015) Africa’s urbanisation: Implications for sustainable development. Cities 47: 62-72.

- Brown D, McGranahan G (2016) The urban informal economy, local inclusion and achieving a global green transformation. Habitat International 53: 97-105.

- Rockström J, Falkenmark M (2015) Increase water harvesting in Africa. Nature 519: 283-285.

- Gumbo T (2014) Scaling up sustainable renewable energy generation from municipal solid waste in the African Continent: Lessons from eThekwini, South Africa. The Journal of Sustainable Development 12: 46-62.

- Scarlat N, Motola V, Dallemand JF, Monforti-Ferrario F, Mofor L (2015) Evaluation of energy potential of municipal solid waste from African urban areas. Renewable and Sustainable Energy Reviews 50: 1269-1286.

- Pasquini L, Cowling RM, Ziervogel G (2013) Facing the heat: Barriers to mainstreaming climate change adaptation in local government in the Western Cape Province, South Africa. Habitat International 40: 225-232.

- Wilson RH, Smith TG (2014) Urban resilience to climate change challenges in Africa. The Robert S Strauss Centre for International Security and Law, Texas, USA.

- Taylor A, Peter C (2014) Strengthening climate resilience in African cities: A framework for working with informality. African Centre for Cities, Rondebosch.

- Obeng-Odoom F (2011) The informal sector in Ghana under siege. Journal of Developing Societies 27; 355-392.

- Eriksen S, Aldunce P, Bahinipati CS, Martins RD, Molefe JI, et al. (2011) When not every response to climate change is a good one: Identifying principles for sustainable adaptation. Climate and Development 3: 7-20.

- Nagoda S (2015) New discourses but same old development approaches? Climate change adaptation policies, chronic food insecurity and development interventions in northwestern Nepal. Global Environmental Change 35: 570-579.

- SITRADE (2009) Abidjan Municipal Solid Waste-To-Energy Project. CDM Project Design Document for the Abidjan Municipal Solid Waste-To-Energy Project. SociétéIvoirienne de Traitement des Déchets, London, UK.

- Lemaire X, Kerr D (2016) Waste Management: Innovative solutions for municipalities. SAMSET Policy Brief. UCL Energy Institute, London, UK.

- IIED (2016) Informality and inclusive green growth Evidence from ‘The biggest private sector’ event 2016”. International Institute for Environment and Development, London, UK.

- Hood C, Adkins L, Levina E (2015) Overview of INDCs Submitted by 31 August 2015. Climate Change Expert Group. Organisation for Economic Co-operation and Development, Paris, France.

- Röser F, Day T, Kurdziel M (2016) After Paris: What is next for Intended Nationally Determined Contributions (INDCs)? International Partnership on Mitigation and MRV and New Climate Institute, Berlin, Germany.

- Day T, Röser F, Kurdziel M (2016) Conditionality of Intended Nationally Determined Contributions (INDCs). International Partnership on Mitigation and MRV and New Climate Institute, Berlin, Germany.

- Zhang W, Pan X (2016) Study on the demand of climate finance for developing countries based on submitted INDC. Advances in Climate Change Research 7: 99-104.

- Hallegatte S, Bangalore M, Bonzanigo L, Fay M, Kane T, et al. (2016) Shock waves: managing the impacts of climate change on poverty. Climate Change and Development Series, World Bank. Washington, DC., USA.

- Biesbroek GR, Swart RJ, Carter TR, Cowan C, Henrichs T, et al. (2010) Europe adapts to climate change: Comparing national adaptation strategies. Global Environmental Change 20: 440-450.

- Buchner BK, Oliver P, Wang X, Carswell C, Meattle C, et al. (2017) Global landscape of climate finance 2017. Climate Policy Initiative, Venice, Italy.

- C40 (2016) New perspectives on climate finance for cities: Finance solutions for new and emerging infrastructure approaches to urban climate mitigation and adaptation. C40 Cities Climate Leadership Group, New York, USA.

- Barnard S (2015) Climate finance for cities: How can international climate funds best support low-carbon and climate resilient urban development? Overseas Development Institute, London, UK.

- Yu Y (2014) Climate finance, Africa and China's role. African East-Asian affairs 1: 36-57.

- Arezki R, Brückner M (2012) Rainfall, financial development, and remittances: Evidence from Sub-Saharan Africa. Journal of International Economics 87: 377-385.

- Chirambo D (2017) Increasing the value of climate finance in an uncertain environment: Diaspora financial resources as a source of climate finance for Sub-Saharan Africa. AIMS Environmental Science 4: 730-742.

- Castello S, Boike C (2011) Microfinance, remittances and small economies. China-USA Business Review 10: 587-599.

- DIDG (2018) DIDG Objectives. The Diaspora Investment Development Group, Zimbabwe, South Africa.

- Mhlanga B (2017) Diaspora, SA consortium raise $400m for NRZ recap.

- Rosen-Zvi I (2011) You are too soft, what can corporate social responsibility do for climate change? Minnesota Journal of Law, Science and Technology 12: 527-572.

- Prasad A (2014) India's new CSR law sparks debate among NGOs and Businesses.

- Jain A, Gopalan S (2017) In India a legislative reform is needed to push social corporate responsibility. Charitable Advisors, India.

- Balch O (2016) Indian law requires companies to give 2% of profits to charity. Is it working?

- Iyigün NÖ (2015) What could Entrepreneurship do for sustainable development? A corporate social responsibility-based approach. Procedia - Social and Behavioral Sciences 195: 1226-1231.

- Tenzer H, Pudelko M (2015) How partnerships between African and European entrepreneurs can support the UN Post-2015 development agenda. African Journal of Management 1: 244-256.

- Gupta S, Beninger S, Ganesh J (2015) A hybrid approach to innovation by social enterprises: Lessons from Africa. Social Enterprise Journal 11: 89-112.

- Byrne R, de Coninck HC, Sagar A (2014).Low carbon innovation for industrial sectors in developing countries: Policy brief. Climate Strategies, London, UK.

- Sagar AD, Bremner C, Grubb M (2009) Climate innovation centres: A partnership approach to meeting energy and climate challenges. Natural Resources Forum 33: 274-284.

- APP (2014) Finance and banking in Africa: Extracts from the Africa progress report 2014. The Africa Progress Panel, Geneva, Switzerland.

- Hallegatte S, Bangalore M, Bonzanigo L, Fay M, Narloch, et al. (2014) Climate change and poverty: An analytical framework. World Bank Group, Washington, DC., USA.

- UMM (2015) Enhancing food security and resilience to climate change: What role for microfinance? UMM thematic paper from the 12th University meets microfinance workshop. University Meets Microfinance Action Group, Paris, France.

- FAO (2016) The state of food and agriculture 2016: Climate change, agriculture and food security. Food and Agriculture Organization of the United Nations, Rome, Italy.

- Meyer RL (2015) Financing agriculture and rural areas in Sub-Saharan Africa: Progress, challenges and the way forward. International Institute for Environment and Development, London, UK.

- Soanes M, Rai N, Steele P, Shakya C, Macgregor J (2017) Delivering real change: Getting international climate finance to the local level. International Institute for Environment and Development IIED Working Paper, London, UK.

- Mutisya E, Yarime M (2014) Microcredit for the development of the bottom of the pyramid segment: Impact of access to financial services on microcredit clients, institutions and urban sustainability. Working Paper Series N° 199African Development Bank, Tunis, North Africa.

- Van Rooyen C, Stewart R, De Wet T (2012) The impact of microfinance in Sub-Saharan Africa: A systematic review of the evidence. World Development 40: 2249-2262.

- Becchetti L, Castriota S (2011) Post Tsunami intervention and the socioeconomic well-being of microfinance borrowers. World Development 39: 898-912.

- Von Uexkull N (2014) Sustained drought, vulnerability and civil conflict in Sub-Saharan Africa. Political Geography 43: 16-26.

- Momo S (2011) Post conflict action and microfinance in Sierra Leone. Spanda Publishing, The Hague, Netherlands.

- Rippey P (2009) Microfinance and climate change: Threats and opportunities. Consultative Group to Assist the Poor, Washington, D.C., USA.

- Rhyne E, Otero E (2006) Microfinance through the next decade: Visioning the who, what,where, when and how: Paper commissioned by the global microcredit summit 2006. ACCION International, Massachusetts, USA.

- Kotir JH, Obeng-Odoom F (2009) Microfinance and rural household development: A ghanaian perspective. Journal of Developing Societies 25: 85-105.

- Weber O, Ahmad A (2014) Empowerment through microfinance: The relation between loan cycle and level of empowerment. World Development 62: 75-87.

- Adenle AA, Ford JD, Morton J, Twomlow S, Alverson K, et al. (2017) Managing climate change risks in Africa - a global perspective. Ecological Economics 141: 190-201.

- Chirambo D (2017) Enhancing climate change resilience through microfinance: Redefining the climate finance paradigm to promote inclusive growth in Africa. Journal of Developing Societies 33: 150-173.

- Mbeva K, Ochieng C, Atela J, Khaemba W, Tonui C (2015) Intended nationally determined contributions as a means to strengthening Africa’s engagement in international climate negotiations. African Centre for Technology Studies, ACTS Press, Nairobi, Kenya.

- GoM (2015) Republic of Malawi Intended Nationally Determined Contribution. Environmental Affairs Department, Lilongwe, Malawi.

- Shakya C, Byrnes R (2017) Turning up the volume: Financial aggregation for off-grid energy. International Institute for Environment and Development, London, UK.

- Nagler P, Naudé W (2017) Non-farm entrepreneurship in rural sub-Saharan Africa: New empirical Evidence. Food Policy 67: 175-191.

- Schumacher I, Strobl E (2011) Economic development and losses due to natural disasters: The role of hazard exposure. Ecological economic 72: 97-105.

- Crick F, Eskander SMSU, Fankhauser S, Diop M (2017) How do African SMEs respond to climate risks? Evidence from Kenya and Senegal. Grantham Research Institute on Climate Change and the Environment, London, UK.

- Baah-Boateng W (2013) Determinants of unemployment in Ghana. African Development Review 25: 385-399.

- Moore K (2015) Fostering economic opportunities for youth in Africa: A comprehensive approach. Enterprise Development and Microfinance 26: 195-209.

- Wong S (2016) Can climate finance contribute to gender equity in developing countries? Journal of International Development 28: 428-444.

- Azeng TF, Yogo TU (2013) Youth unemployment and political instability in selected developing countries. African Development Bank, Tunis, Tunisia.

- Abubakar IR, Doan PL (2017) Building new capital cities in Africa: Lessons for new satellite towns in developing countries. African Studies 76: 546-565.

- Padgham J, Jabbour J, Dietrich K (2015) Managing change and building resilience: A multi-stressor analysis of urban and peri-urban agriculture in Africa and Asia. Urban Climate 12: 183-204.

- Kiunsi R (2013) The constraints on climate change adaptation in a city with a large development deficit: The case of Dar es Salaam. Environment & Urbanization 25: 321-337.

- Johnson O, Muhoza C, Osano P, Senyagwa J, Kartha S (2017) Catalysing investment in sustainable energy infrastructure in Africa: Overcoming financial and non-financial constraints. Stockholm Environment Institute, Nairobi, Kenya.

- Schwerhoff G, Sy M (2017) Financing renewable energy in Africa - key challenge of the sustainable development goals. Renewable and Sustainable Energy Reviews 75: 393-401.

- OECD (2012) Strategic environmental assessment in development practice: A Review of Recent Experience. The Organisation for Economic Co-operation and Development, Paris, France.

- Rong F (2010) Understanding developing country stances on post-2012 climate change negotiations: Comparative analysis of Brazil, China, India, Mexico and South Africa. Energy Policy 38: 4582-4591.

- UNECA (2011) Assessing progress in Africa toward the millennium development goals: MDG Report 2011. United Nations Economic Commission for Africa, Addis Ababa, Ethiopia.

- Sireh-Jallow A (2017) Revenue diversification: Non-traditional sources of development finance as game changers in Africa. International Journal of Economics and Finance 9: 275-282.

- GoU (2015) Uganda’s Intended Nationally Determined Contribution (INDC). Ministry of Water and Environment, Government of Uganda, Kampala, Uganda.

- Weigel M (2016) China’s climate change south-south cooperation: Track record and future direction. United Nations Development Programme in China, Beijing, China.

- NDRC (2015) China's policies and actions on climate change. The National Development and Reform Commission, Beijing, China.

- Pelling M, Leck H, Pasquini L, Ajibade I, Osuteye E, et al. (2018) Africa’s urban adaptation transition under a 1.5°C climate. Current Opinion in Environmental Sustainability 31: 10-15.

- Filho WL, Balogun A, Olayide OE, Azeiteiro UM, Ayal DY, et al. (2019) Assessing the impacts of climate change in cities and their adaptive capacity: Towards transformative approaches to climate change adaptation and poverty reduction in urban areas in a set of developing countries. Science of the Total Environment 692: 175-1190.

- Chirambo D (2018) Managing conflict through private sector action on the growth-climate-peace nexus: A new microfinance paradigm for Sub-Saharan Africa. Journal of Conflict and Integration 2: 76-108.

Citation: Chirambo D (2020) Reducing Climate Change Vulnerability in Sub-Saharan Africa Cities: Policy Prospects for Social Innovation and Microfinance. J Environ Sci Curr Res 3: 019.

Copyright: © 2020 Dumisani Chirambo, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.