The use of Contracts for difference (‘CFD’) Spread Bets and Binary Options (‘forbin’) to Trade Foreign Exchange (‘forex’) Commodities and Stocks and Shares in Volatile Financial Markets

*Corresponding Author(s):

Barnes PDepartment Of Anthropology, University College London, United Kingdom

Tel:+44 20 7679 2000,

Email:paulanthonybarnes@outlook.com

Abstract

This paper examines the popularity of forex and derivatives - contracts for difference (‘CFD’) spread bets and binary options - at a time when the markets are turbulent and speculating by trading is popular. The paper provides theoretical calculations of the probability of success of trading in this way together with empirical evidence. These show that it is not possible for the trader to trade profitably over the medium- to long-term as these markets are efficient and that the broker, who is the counterparty, will win just like a casino or bookie. It is also shown that these markets have become susceptible to scams and fraud but argues such actions are unnecessary for the broker as it will win as long as the trader continues to bet. Finally, it is argued that whilst forex is the most popular asset traded, its price movements are more difficult to predict and are much smaller compared with stocks and shares and commodities, making it even more difficult for traders to trade them successfully.

Keywords

Binary options; Boiler room; Bucket shop; Contracts for difference; CFD; Forex; Forbin; Fraud; Stocks; Shares; Securities; Spread betting; Scam

Introduction

Despite the economy and world trade collapsing around it, there is one sector that has boomed. This is that part of the financial sector comprising financial brokers providing foreign exchange (‘forex’) contracts for difference (CFD) and spread betting services and, until recently, binary options (collectively referred to as ‘forbin’). Betting (‘wagering’) on price changes in forex, stocks and shares, commodities and even cryptocurrencies, in volatile conditions caused by such factors as Brexit, the Donald Trump’s presidency and the coronavirus has become understandably popular.

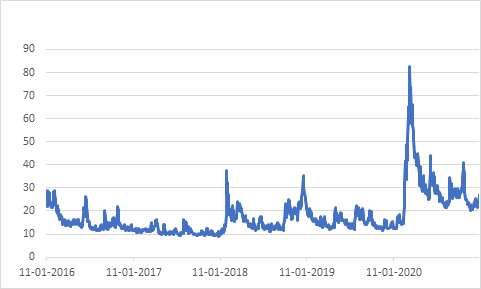

Volatility has been seen by many as not so much as an investment opportunity but a chance to make money by wagering on its movements to such an extent that a volatility index has been devised by the Chicago Board Options Exchange representing the market's expectation based on the S&P 500 options index to help investors. See Figure 1 which shows considerable increases during early 2020 and spikes in 2018 and 2019. With the prospect of continued market volatility, technical developments in these instruments which have increased their appeal, wagers on short term movements in stocks and forex (as with online betting generally) is likely to continue to boom. The main firms (they like to refer to themselves as ‘brokers’) are profiting from this, reporting record growth and profits from an upsurge in the demand for forbin products. Three of the largest brokerage firms experienced on average a rise in their share prices of 81.15% over the year to 11 January 2021 whereas the FTSE100 fell by 10.96%.

Figure 1: Chart showing the daily level of the CBOE VIX Volatility Index for five years to 10 January 2021.

Figure 1: Chart showing the daily level of the CBOE VIX Volatility Index for five years to 10 January 2021.

* The VIX index measures the expectation of stock market volatility over the next 30 days implied by S&P 500 index options.

On the other hand, complaints and legal actions by customers and intervention by regulators highlight the controversial nature of forbin. There have been a number of actions against firms providing trading services. For example, regulators throughout the world such as the FCA in the UK, the SEC and CFTC (Commodity Futures Trading Commission) in the US, ASIC in Australia and CySec in Cyprus (a popular location for many of the firms to be registered) have fined or closed down firms for the way in which they have scammed customers. There have also been a number of actions by individuals claiming to have been defrauded by these firms (some of which are the largest and most reputable) even class actions against some of the largest. There are probably many more aggravated investors who have lost their money and contemplating legal action (Table 1).

|

|

Commission* |

‘Bid-ask’ Spread |

Deposit or ‘Margin’ |

Tax on profits |

Expiry date |

|

Derivatives |

|||||

|

CFD |

0.1% - 0.5% of the value of the trade. |

Implicit |

Variable 5% - 400% |

Liable to capital gains tax |

None |

|

Spread betting |

Not usually |

Implicit |

Variable 5% - 400% |

None |

Yes, but rollovers possible |

|

Binary options** |

None |

None |

Variable 5% - 400% |

None |

None |

|

Direct purchase/sale |

|||||

|

Stocks, shares & bonds |

0.1% - 0.3% of the value of the trade. |

Implicit |

None |

Liable to capital gains tax |

None |

|

Forex |

0.05% - 0.1% of the value of the trade. |

Implicit |

None |

Liable to capital gains tax |

None |

|

Commodities |

0.1% - 0.1% of the value of the trade. |

Implicit |

None |

Liable to capital gains tax |

None |

Table 1: Forbin types and direct purchase/sale of assets compared

* Alternatively, there may be a fixed fee available

** Now largely banned for retail investors, see text.

Although asset prices are determined by supply and demand, these are in turn determined by the market’s (i.e. traders’) beliefs and expectations about the worth and prospects of those assets. These vary according to the type of asset. For example, adverse weather may affect the price of a commodity such as coffee or bananas whilst stocks and share prices may be determined not only by firm-specific factors but also by more general economic variables and political events. This makes equities and forex particularly attractive assets to many people on which to speculate. Nevertheless, brokers’ websites and their marketing information invariably highlight the risks involved in forbin. They often state that as many as 70% of retail investor accounts lose money when trading CFDs. On the other hand, many ’informed’. and ‘professional’ investors make money. It is the purpose of this article to discuss these issues: explain how forex and forbin instruments work, the ability of individuals to forecast price changes in a period of such volatility, their probability of success and why most retail investors do lose money and, finally, the activities of brokers giving rise to distrust by customers and intervention and concerns of regulators. This article follows on from an earlier article by me in whom I discussed other issues and aspects of forbin [1]. I have tried here to minimise the overlap but some introductory explanations are necessary so that the paper is self-standing.

How Forbin Instruments Work And May Be Used

Forex

This is the largest financial market in the world, with US$1.5 trillion changing hands every day. It is very liquid, meaning it is easy to buy and sell currencies, and open 24 hours. In the UK to speculate in forex as an investment, through a broker, an individual may buy and sell the currency, open a CFD account, or a spread betting account. All forex is quoted in ‘pairs’ in which there is a ‘base’ and a ‘counter’ currency. For example, in the case of the Euro, EUR/USD, EUR is the base currency and USD (US dollar) is the counter currency and is expressed as the value of one Euro in US dollars. If the trader thinks the base currency will rise (‘strengthen’) and/or the counter currency will fall (‘weaken’) he/she will buy (i.e. ‘go long’) Euro. If he/she thinks it will weaken, he/she will sell (i.e. ‘go short’). Most currencies are quoted to five decimal places where the change in the fourth decimal place (0.001) is referred to as a ‘pip’. So, if EUR/USD moved from 1.33800 to 1.33920, it is said to have risen by 12 pips. A ‘lot’ (as in ‘price per lot’) is the standard trading term for an order of 100,000 units of the base currency. The term ‘round term’ refers to a single completed trade, i.e. both a buy and a sell, as opposed to half of the full trade, i.e. a buy or a sell. Currency pairs fall into four main categories: majors, minors, crosses and exotics. Majors always involve the US Dollar (USD) being traded against other major currencies, namely the Euro (EUR), the British Pound (GBP) the Swiss Franc (CHF), the Japanese Yen (JPY), the Canadian Dollar (CAD), the Australian Dollar (AUD), and the New Zealand Dollar (NZD). Minors and crosses involve one of the majors against a range of currencies that are traded in smaller quantities. There are three main markets: the Spot Forex Market, the physical exchange of a currency pair, taking place on the spot date (usually, this refers to the day of the trade plus 2 days – ‘T+2’), the Forward Forex Market, an Over the Counter (OTC) contract to buy or sell a set amount of a currency at a certain price at a future date, and the Forex Futures Market. A forex futures contract is an exchange-traded contract to buy or sell a specified amount of a given currency at a predetermined price on a set date in the future.

Spread bets

In a financial spread bet, profits and losses are calculated on the number of dollars per point the stock rises above/falls. The trader would be required to make a deposit (known as ‘leverage’ or ‘margin’ discussed below) and not pay the full amount of the trade. Spread bets usually do not attract commission; instead, the difference between the bid and offer price (the ‘spread’) is widened. All spread bets have an expiry date when the profit/loss will be realized.

CFDs

A CFD is similar to a spread bet and popular in the UK and Europe but US individuals are no longer allowed to buy them and they are banned in various other countries. A CFD is simply an agreement between a broker and a customer to pay the difference between the opening price and closing price of an asset.

Binary options

As it does not involve the right to buy the underlying asset, technically, a binary option is not an option. It is little more than a simple wager on whether the price of an asset will rise (‘go long’) or fall (‘go short’) over a specified period. Hence the word ‘binary’ as there are only two possible outcomes. The advantage of a binary option is the shortness of its expiry time. There are two different types of expiry: with confirmation expiry, where the trader predicts where the market will be at a specific point in time; and with deadline expiry, where the trader predicts that the market will do something within a time span. Profits from CFDs and direct investment in stocks and shares, forex and commodities are liable to capital gains tax, although losses can be offset against future taxable profits. Profits from spread bets and binary options are tax-free. There are some other technical aspects to be considered affecting the size and profitability of a trade. These are:

Leverage or margin

As a trader is using a binary option, CFD or spread bet and not actually buying or selling the asset, he/she is only required to make a deposit, for example 5%, known as ‘leverage’ or ‘margin’. This means that the trader can make a much larger wager for the same amount of money using forbin rather than purchase the asset. The effect of margin/leverage on a trader’s risk is enormous. Risk increases in proportion to the leverage. With a 5% margin, the trader may make a wager 20 times as large for the same initial payment, i.e. he/she only pays 5%. A trader can, therefore, start trading with as little as £100 to obtain the effect of £2,000 capital. With some brokers the leverage offered may not be 20 times but 100, 150 times and much more, 500 and 1,000 times at the time of writing, although it may vary across assets.

However, whilst the profits a trader may make are huge, so is the risk and it is possible that the trader may incur a loss which could be so large as to exceed the deposit. For example, if the margin is 100 times rather than 20 times, for a wager which maximises the leverage, it is 5 times as risky. The effect is also to make binary options riskier than CFDs and spread bets. Say there is a 50:50 chance of winning and the maximum permitted leverage is 100 times and the trader wagers £1,000 based on his deposit of £10 and there is either a 1% gain or a 1% loss and the broker’s fee and spread for the CFD or spread bet are 0.5%. The loss would be £1,000 and the gain would be £750 for a binary option (range £1,750) and £15 and £5 for a CFD or spread bet (range £20). The loss is (1.5% X £1,000) = £15 where 1.5% is the loss plus the broker’s commission (1% and .05%) and the gain is £1,000 X 0.5% = £5 where 0.5% is the gain (1%) less the broker’s commission (0.5%). (In statistics, range is defined as the difference between the largest and smallest values. Here, it is the difference between the loss and gain for a specific amount of leverage.) Of course, the trader need not maximise the size of the wager. In the example above, this would probably foolhardy and reckless.

The ‘bid/ask spread’

As with stocks and shares, there is a ‘bid/ask spread’ for CFDs and spread bets but not for binary options. This is the difference between the buy price (‘offer’ or ‘ask’) the trader has to pay to buy the asset (‘ask’ price) and the price the broker will pay the trader when it is sold (‘bid’ price). The size of the spread depends on the ‘liquidity’ (volume of trade) of the asset; in the case of a fairly liquid asset this may be between 0.1% and 0.2% of the value of the trade.

The counterparty to the deals

Invariably, the broker is the counterparty to these trades. It is not actually buying or selling the asset but merely accepting a wager on its price movement, acting effectively as the banker. So, if the trader wins a trade, the broker loses the same amount. This point is important later when examining the broker’s motives leading to scams and fraud. A traditional brokerage firm which offers real options rather than CFDs and spread bets, will hedge an investor’s trade if it considers necessary. That is, it will, itself, enter into an equal and opposite trade so a potential loss is covered and there is no risk from the investor’s trade. Brokers providing forbin services to day traders may decide hedging their customers’ trades is unnecessary as on average they will win and not wish to reduce their profits by unprofitable hedged trades.

Calculating profits and losses

See Table 2 for an illustration of how these instruments work where the wager is £10. It shows how both the trader’s profits and losses are calculated for successful and unsuccessful trades. In the case of a CFD and spread bet, the trader makes a profit or incurs a loss amounting to the size of the price gain or loss, a profit of 10% or a loss of 10%. It should be noted that CFDs and spread bets are subject to a brokers’ charge (the bid-ask spread plus, possibly a commission) irrespective of whether the trader is or not successful (in the example 0.5%) whilst a binary option incurs no fees but if the trader is unsuccessful; he/she loses the entire stake. If he/she wins, they win a percentage of the stake (here 75%) irrespective of the size of the price change.

|

|

CFDs and Spread bets |

Binary Options |

|

Wager |

£10 |

£10 |

|

Profit pay-out |

100% |

75% |

|

(a) Profit |

10% |

10% |

|

Gross profit |

£1 |

£0.75 |

|

Broker’s fees/spread |

0.5% |

0 |

|

Net profit |

£0.995 |

£0.75 |

|

(b) Loss |

10% |

10% |

|

Gross loss |

£1.0 |

£10 |

|

Net loss |

£1.005 |

£10 |

Table 2: Illustration of profit/loss to be made on CFDs, Spread bets and Binary Options under (a) a successful wager and (b) unsuccessful wager

These are the basic principles although there are devices for traders to limit their losses and brokers may provide incentives and tweak the terms but the example demonstrates a number of things:

How easily it is for a customer’s balance with a broker to fall below the required margin, the sensitiveness of the calculations (and therefore profits) to the prices used, How important it is to make more than 50%. As the likelihood of success is at best only 50%, the trader will lose in the long term. He/she may make profits initially and during ‘lucky periods’ but overall, the ‘regression to the mean’ principle will apply and the customer will lose. This principle states that the variation in the average of a series of numbers will decrease as the population increases. Take the tossing of a coin; the probability of turning a head or a tail are both 0.5. If you toss a coin twice, the probability of getting one of each is low but as you toss the coin more times the number of heads and tails will converge on 50:50. The upshot is that in the long run, the broker as the counterparty will win. All it has to do is encourage the customer to continue betting. Despite this, there may be good reasons for an individual to decide to use forbin and trade successfully. These include:

One-off or occasional trades, say when the individual has received a tip that the price of an asset is likely to rise or fall, or has some knowledge of a forthcoming or likely event that will affect its price/value. Another common situation is where an individual spots an ‘arbitrage’ situation from which he/she may profit. Arbitrage relates to situations where there are different prices of the same asset in different markets, where a trader may buy the asset in one market and sell it in another for profit if the price difference is sufficiently large to cover transaction costs, e.g. a share price is different on the London Stock Exchange to that on the NYSE. Arbitrageurs may look for other opportunities such as the difference between a share price and the company’s net asset value. It is sometimes argued that arbitrageurs perform a useful purpose by removing ‘inefficiencies’ in the markets.

Regular day trading, day trading is the purchase and sale of an asset within a single trading day, or at least a short period of time. Day traders typically use large transactions involving high amounts of leverage (discussed later) to profit from small price movements in highly liquid assets. Successful trading will be based on events that cause short-term market movements such as the release of new economic statistics and corporate earnings and changes in interest rates but also factors likely to influence market expectations and market psychology.

Day traders use various strategies including: ‘Scalping’, attempts to make small profits on small price changes throughout the day, ‘Range trading’, and often referred to as ‘technical analysis’ or ‘swing trading’, based on tramlines’ within which an asset’s price may fluctuate. The idea is that when the price of an asset rises on the market, it is often followed by a price fall to correct the price and that the price bounces between these two limits. The upper limit is sometimes referred to as the ‘resistance level’, the lower limit, the ‘support’ level. ‘News-based trading’, which typically seizes trading opportunities from the heightened volatility around news events ‘High-frequency trading’ using sophisticated algorithms to exploit small or short-term market inefficiencies.

Some day traders make a successful living despite the risks. Either they work alone or for a financial institution. The latter have an advantage because they have access to a direct line, a trading desk, large amounts of capital and leverage, expensive analytical software and professional expertise. These traders are typically looking for profitable opportunities that can be made from arbitrage and news events; their resources help them to capitalize on these opportunities before other traders are able to react.

Hedging

Hedging is a useful means of minimising risks and losses for a long- or medium- term investor, when the market is volatile. This done by selecting another investment that is inversely correlated to the vulnerable asset. The easiest and most common way of doing this is through derivatives such as forbin and the use of CFDs in this way is well documented [2]. So, if the market price of the vulnerable asset were to fall, the price of the other investment would rise correspondingly – and vice versa. Say an investor holds 10,000 shares in X plc and thinks its price will fall over the short term. He/she could cover the potential loss by buying a CFD short that will cover the 10,000 shares owned. If the share price rises, the investor would profit from this but lose on the CFD trade. If the share price fell, the investor’s profit from the CFD trade would offset the loss on the stock. An investor in commodities may hedge in a similar way by buying a put CFD and if the price of the holding in the commodity fell, his/her loss would be compensated by the profit on the CFD.

Forecasting Price Changes In A Period Of Volatility

Financial markets, such as the leading stock exchanges, commodity and forex markets are regarded by economists as ‘efficient’ because all existing information is already built into the current price of the asset, together with expectations about the future inferred from that information. As future news is, by definition, not known, it is just as likely to be good or bad. Therefore, changes in asset prices are said to follow a ‘random walk’ in the sense that a price change on one day is uncorrelated with the price change the next day [3]. During volatile market conditions, new information may be subject to reinterpretation and the notion of a ‘once and for all’ price adjustment may not be justified. Nevertheless, the important point remains: an investor cannot out-perform the market, i.e. he/she cannot consistently make higher returns than the market as a whole, say as measured by a market index, without inside information. Further, guesses about security price changes cannot consistently be correct more than 50% of the time [3].

Figure 2: Dow Jones Industrial Average Index: Wednesday 4 November 2020.

Figure 2: Dow Jones Industrial Average Index: Wednesday 4 November 2020.

In recent years, economic and political factors have been causing turbulence in the financial markets from which a person interested in these things may be tempted to attempt to profit. At the time of writing, (January 2021) not only do we not know the full effects of the final Brexit negotiations as they affect the UK and European markets, we also do not know the prospects of the severity of the coronavirus and the economic effects of this and the end of the Trump presidency.

The stock market reaction at the time of the US election which was lauded by brokers as a great opportunity to make money is illustrative of the potential and attraction of betting on the outcome of political and economic events. Consider the movements of the US equity markets around the time of the announcement of the results which illustrate how the market would only adjust to the extent that the probability and expectations are changed. Initially, the markets reflected the belief in opinion polls of a narrow Biden victory because of his small lead in some of the closer states and that a win would be accompanied by a substantial economic rescue package. It was also known that early voting was extensive and that this was primarily Democrat whereas voting on the day was Republican. The change in expectations of a Trump victory and his statement that he would contest a Biden win initially caused a dip in the equity markets. See the Dow Jones Industrial Average Index for Wednesday 4 November in Figure 2. But it was short-lived and the markets recovered.

The Probability Of Success And Why Most Retail Investors Lose Money

It is possible to calculate the odds of success for each type of forbin but first consider the likelihood of winning in the casino game roulette. If the player wins, the bank (the casino) pays out double the stake. So, for the player to break even, it is necessary to win 50%. Let p = the probability of success and k and g and represent loss and gain respectively. In which case, p.g = (1 – p)k as g = k this simplifies to p = (1 – p) so p = 0.5. This is also the case with CFDs and spread bets where the probabilities of gains and losses are symmetrical, i.e. the value of a loss and a gain are equal; similarly, the probabilities of a gain and loss are equal. If the broker’s fees/spread are 0.5% as in the example in (Table 2), the probability of success would need to be 0.501247. Here p.g = (1 – p)k and k = 1.005g which simplifies to p = (1 – p)1.005 so p = 0.501247.

Whilst a spread is the usual way for brokers to extract fees, this is not the case with binary options as the terms are sufficiently advantageous for brokers to state that they do not apply a spread and there are no hidden spreads. Also, whilst the probabilities of gains and losses are symmetrical, i.e. 50%. and fixed amounts, the loss and gain are not symmetrical. Either the trader loses the entire stake (although it may be limited by some brokers) or wins a fixed amount, between 65% and 80% of the stake, depending on the broker’s terms. (In the example in (Table 2), it is 75%.) For this reason, they are sometimes called ‘fixed odds financial bets’. The important point is that the chance of profiting from a binary option is less than a comparable bet in roulette. if a success rate of 50% is the best that can be achieved in order to break even, it would be necessary for the trader to be paid 100% of gains from profitable trades and not a percentage. The probability of success would need to be 0.5714 in order to break even if the pay-out is 75%. Here p.g = (1 – p) k and g = 0.75k so p = 0.5714. In fact, the chance of winning in practice will probably be less in both as in roulette there may be a zero and in binary options, if the price is unchanged, brokers usually treat this as a lost trade. Conventionally, in the roulette game there are numbered slots between 1 and 36, plus, in the American version, a zero. In which case the chance of winning goes from 18 to 18, 50%, to 18 to 19, 48.6%.

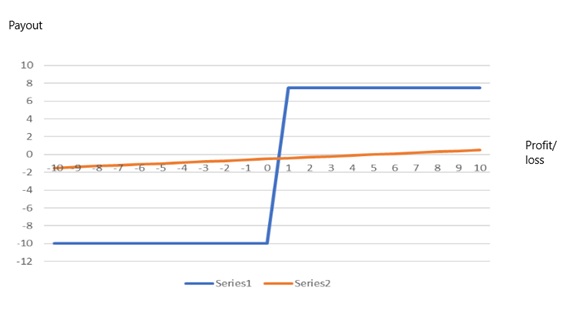

As their terms are different, the risk and returns for binary options and CFDs/spread bets are different. Losses for a CFD/spread bet will be larger compared with a binary option where the loss is truncated and the customer loses his/her stake. On the other hand, if the loss is quite small, it will be smaller for the CFD/spread bet than for the binary option. In the case of profits from a successful trade, the holder of the CFD/spread bet will receive 100% of the profits whereas the owner of the binary option will receive a fraction, e.g. 75% of the stake as in the example in (Table 2). This is illustrated in Figure 3. Here the orange line represents a CFD/spread bet and the blue line represents a binary option where the stake, s = 10, the profit/loss ranges between plus and minus 10% (the vertical or y axis) the pay-out is 100% for the CFDs and spread bets and 75% for binary options and the resultant profit/loss to the trader is on the horizontal (or x) where administrative expenses are 0.5% of the stake for CFDs and spread bets and zero for binary options and the probability at which they break even for binary options is 0.5714.

Figure 3: Comparison of binary options (blue) and CFD/spread betting (orange) profitability

Figure 3: Comparison of binary options (blue) and CFD/spread betting (orange) profitability

As they incur both costs of the bid-ask spread and, probably, a broker’s commission, the profitability of CFDs and spread bets to the trader depends on the probability of the price change on the trade. This has various significant implications. Firstly, it is possible that whilst a price change may be in the right direction for the trader, it may not be sufficient to cover the bid-ask spread and therefore render the trade unsuccessful. For instance, at the time of writing, the price for shares in Rio Tinto is 6119p where the bid and ask prices are 6118p and 6120p. If the price rose to 6120p where the bid and ask prices were 6119p and 6121p and the trader was wagering on a price rise, he/she would be unsuccessful as the bid price is below the ask price at the time of the trade, i.e. 6119 < 6120. Secondly, the bid/ask spread causes the realized price change to be insufficient to cover the brokerage costs for the trade to be profitable. Thirdly, once the full broker’s costs are taken into account, the probability of success falls below 50%. For example, if the probability is 0.5, the price gain will need to be 0.1% if the broker’s total fees are 0.5%. If the price change is less than this, even if the trade is successful, the trader will incur a net loss. That is (0.5 X 0.1%) = 0.5% in terms of the earlier algebraic notation: p/0.5 = g% where the broker’s total fees are 0.5%.

Are Price Rises Sufficiently Large for Profits to be Made?

It has been argued that price movements are not predictable although equity and commodity market prices may change in response to economic, political and other factors. Forex price movements are even more difficult to predict, because they mainly arise from market makers balancing day to day supply and demand for the currency, although they will also be sensitive to macroeconomic factors affecting a nation’s trading prospects. Predicting forex price changes is also difficult as it is expressed in paired prices where the price of one currency is expressed in terms of another, e.g. GBP/USD, where as a result GBP/USD will move as a result of changes in the value of either currency.

It is the purpose of this section to examine the empirical evidence using daily price changes for a sample of assets and indices. It will be seen that most of the overall daily price changes in (Table 3) are small and the z-values indicate the averages are not statistically significantly different from zero at the 5% level. (A z-value states how many standard deviations a variable, x in the equation z = (x-μ)/σ where μ is the population mean and σ is its standard deviation, is away from the mean, e.g. if a z-score is equal to 0, it is on the mean). This is to be expected as it has been argued the probability of a price rise or fall would, in the absence of information, be equally likely and therefore the overall average will be around zero. The prices of Plus500 plc and silver rose during the period due to specific factors affecting the markets at that time. The price of silver along with other precious metals is known to rise during difficult economic conditions. The price of shares in Plus500 would have been expected to benefit from increased betting on the markets.

|

Price/ Index |

Price rises |

Price falls |

Absolute value of rises and falls (average |

Overall |

|||

|

Average % (and Standard deviation) |

z-value |

Average % (and Standard deviation) |

z-value |

Average % (and Standard deviation) |

z-value |

||

|

FTSE100 |

1.1749 (1.1733) |

1.0014 |

1.3682 (1.5416) |

0.8875 |

1.2715 |

-0.0223 (1.8629) |

-0.0120 |

|

Whitbread plc |

3.5793 (3.4343) |

1.0422 |

3.1917 (3.5144) |

0.9082 |

3.3855 |

-0.2600 (4.8097) |

-0.0541 |

|

Rio Tinto plc |

1.9665 (1.7764) |

1.1070 |

2.0288 (1.9498) |

1.0405 |

1.9976 |

0.1759 (2.7138) |

0.0648 |

|

Plus500 plc |

1.7812 (1.9380) |

0.9191 |

2.3195 (2.7186) |

0.8532 |

2.0503 |

0.3526 (3.1488) |

0.1120 |

|

AUD/USD |

0.5833 (0.5462) |

1.0679 |

0.5434 (0.5556) |

0.9780 |

0.5633 |

-0.0489 (0.7887) |

-0.0620 |

|

UKP/USD |

0.4660 (0.4306) |

1.0822 |

0.4978 (0.5639) |

0.8828 |

0.4819 |

-0.0175 (0.6915) |

-0.0252 |

|

Silver |

1.7829 (1.9077) |

0.9346 |

1.8727 (2.2700) |

0.8875 |

1.8278 |

0.1869 (2.7567) |

0.0678 |

Table 3: Daily price changes for a sample of stocks, forex and a commodity and a market index for the year to 10 January 2021

Note:

- ‘*’ indicates not significantly different from zero at 5% level.

- As only daily prices are publicly available, even though a trade may be for a different period, it has to be assumed that the daily price change is a reasonable proxy for the price change that day available for the trader

Are price changes that are in the right direction sufficiently large for a trader to profit if they need to cover broker’s fees of 0.5%? Columns 2 to 6 of (Table 3) show that for the FTSE100, the sample of equities and commodities, both the average price rises and price falls were relatively large but were not statistically significantly different from zero, although possibly sufficiently large for traders to profit. In the case of the averages for the forex examples (AUD/USD and UK/USD), the averages were much smaller, again not statistically significantly different from zero and not sufficiently large for a trader to profit if the broker’s fees are 0.5%.

The Regulation of Bin

The law

In the UK, brokerage firms are regulated by the Financial Conduct Authority (FCA). They are either authorised by the FCA under Section 19 2000, the Financial Services and Markets Act (FSMA) or by the European Securities and Markets Agency (ESMA). Under FSMA, the FCA is also able to provide firms that are authorised in the European Economic Area (‘EEA’) with a ‘passport’ across border services to UK citizens in line with the Markets in Financial Instruments Directive 2004/39/EC (‘MIFID’). Sections 205 and 206 of FSMA state that If the FCA considers an authorised person to have contravened a requirement under the Act, it may publish a statement to that effect, known as a ‘Decision Notice’ or ‘Public Censure’ and, if there has been a contravention the Act, it may impose a penalty. The criteria used to decide if an authorised business’ or an individual’s conduct has been satisfactory is contained in their ‘principles of business’. If a provider is authorised by the FCA and fails, closes down, or goes into liquidation and there is a deficiency in the client money bank account, customers may be covered by the Financial Services Compensation Scheme (‘FSCS’) up to a maximum of £50,000. Under EU financial services law, brokerage firms that are legally established in an EEA country may do business in any other country in the area once certain procedural safeguards are met. The EEA includes all EU countries plus Norway, Lichtenstein, and Iceland. In the US, the primary securities regulator at the federal level is the Securities and Exchange Commission (SEC); derivatives are regulated by the Commodity Futures Trading Commission (CFTC).

Until January 2018, binary options in the UK were effectively regulated by the Gambling Commission but, from 3 January 2018, UK firms offering these products were required to be authorised by the FCA and from 2 April 2019, it banned firms from selling binary options in the UK. Therefore, as the sale of binary options is now banned, any firm offering them is probably unauthorised or a scam. Binary options are also banned firms from sale to retail consumers across the EU They are not popular in the US and are only legally available to those who purchase them using the American Stock Exchange, Chicago Options Exchange and Nadex. It is not legal for US citizens to purchase binary options from any other source.

Distrust by customers and intervention by regulators

If the customer loses all his/her money, he/she will want to blame someone, probably the broker. It may be possible for the customer to recover his/her losses if this can be proved. Here are some types of behaviour by brokers that may successfully be claimed by a victim.

Hidden costs

There is a potential problem concerning the prices at which trades are made. The customer may believe that he/she had bought at a specified price and closed the deal at a certain price. However, when examining the account, he/she may discover that different prices have been used and recorded by the brokers affecting not only whether the customer has won or lost the trade but also the amount. It is possible that there is a gap, perhaps seconds or a fraction of a second, between when the trader makes a trade and the broker effects it. This is understandable and is called ‘slippage’. It is likely to occur during a period of high volatility when market orders are made. If slippage does occur, the price recorded by the broker at the time of execution may be different to that of the trader. The effect is just as likely to be favourable to the trader as unfavourable, i.e. random. Say the prices in a EUR/USD transaction were: what the trader thought and saw on the website: 1.00 (opening) and 1.10 (closing) but the broker recorded 1.12 (opening) and 1.10 (closing), i.e. the two parties agreed on the closing price but not on the opening price. Say the wager was that the price would (a) rise and (b) fall. In which case under (a) the trader thought the wager was won but according to the broker it was lost; under (b) the trader thought the wager was lost but according to the broker it was won. The outcome of a binary option wager would be affected; in the case of a CFD or spread bet, the size of the profit or loss would be affected but random whether this was favourable or not for the trader.

Whilst slippage may be understandable and acceptable, a distinction should be made between it and a ‘hidden spread’ where there is a difference between the price at which the trader executes (or thinks he/she has executed) a trade and the price applied by the broker. With some brokers, the price recorded never appears on the web page (trading platform) and results in a loss to the trader, i.e. the price is adjusted by the broker to its advantage. If it were random, the chance of it being to the trader’s advantage would be the same as it being to the trader’s disadvantage. It should also be noted that a hidden spread may not be sufficiently large to affect the outcome of a binary option deal (i.e. whether the Defendant won or lost). If this occurs, it should be seen to be as not only unethical but fraudulent. Unfortunately for the trader, the price applied is not usually recorded by the broker and so the trader is unable to show how he/she had been defrauded unless he/she had taken a screen shot of the web page.

Deception and dishonesty

The trader may choose not to trade him/herself but, instead, to use a ‘professional’ (an independent ‘expert’) to decide on and execute deals or be guided by an adviser or account manager employed by the brokerage firm. There have been many complaints about these advisers: that they simply encourage, cajole or even order clients to trade recklessly, persuading them to contribute as much of their funds as possible by, for example, offering traders promises of guaranteed trades. The purpose of all this is to maximise the amount of money obtainable from a client and run down his/her balances as quickly as possible. It is obvious that these ‘advisers’ who effectively carried out the trades for clients, are aware of the effects of their efforts and are simply acting in their own and the broker’s interests. This is known as ‘churning’ and occurs when, unknown to the customer, an unnecessary number of trades are done by the advisers as they are paid commission for each deal executed. Also, of course, as the broker is the counterparty, it is in both the interests of the adviser and the broker that as many deals as possible are put through as quickly as possible until the client’s money is exhausted.

There are many ‘professionals’ offering so-called ‘expert advice’ for traders which is actually rudimentary, such as the times of earnings announcements and official economic statements and forecasts etc. Whilst there may be profit to be made from the difference between market expectations and reported profits, it is necessary for the trader to know not only the profits expected by the market but also the likely reported profit prior to their announcement. This is no easy feat but, without this, the trader would not know whether the asset price would rise or fall. Quite often, the declaration of record profits for a company is accompanied by a fall in its share price because the market was expecting better results [3]. Advice of this kind may amount to what has been called a ‘signal seller scam’, where information purporting to be professional forecasts are sold to inexperienced traders which are guaranteed to make money for the inexperienced trader. A recent development of this is the automated trading system which will trade automatically for an inexperienced trader. All he/she need do is hand over the money to the firm administrating the service. An example of this is Forex Pro Island, an automated trading system for forex which will trade automatically for a trader and claims on its website to be so profitable a user will be able to give up his job. Of course, this is not the case, it is a scam and the trader will lose his/her money.

Do these scams amount to fraud? If a broker has any sense, it will not manipulate the trades or records avoiding any claims of ‘churning’ and just allow the trader to lose the money. It would have to be shown that the brokers deliberately intended for the client to lose all his/her money. Can the individuals recover the money? If the brokerage firm is authorised by the FCA, this may be possible or f it can be shown that the broker is a ‘clone’, victims may have a good case.

Exploitation

There have been cases where traders have complained that brokers have exploited stock market ‘pauses’ - when the market crashes and trading is halted by the exchange or a ‘flash crash’, when it crashes due to a technical problem. Probably the most dramatic example of the former which caused a major upset in the forex market was the decision of the Swiss National Bank (SNB) on 15 January 2015 to remove the floor to the EUR/CHF (Euro/Swiss Franc) pushing up the Swiss franc by almost 30% and forcing down the Euro by 16% and affecting other currencies such as the US dollar and the pound. There have been various smaller market crashes halting trading during the early stages of the coronavirus crisis in 2020. Flash crashes have also occurred occasionally, e.g. the Dow in 2010, the NASDAQ in 2013, the US bond market in 2014, the NYSE in 2015 and the 2016 UK sterling crash. As these derivatives are not dealt on the market, they are not affected by the suspension of trading. Nevertheless, a broker may decide to suspend trades. This may be unfair to, and could punish, traders with open trades at the time, thereby benefiting brokers as the counterparty. For instance, if a customer was wagering on a price fall and prices crashed, closure by the broker would limit the trader’s gains and protect the broker from a large loss. Similarly, if the trader were betting on a rise, the crash would have caused the trader to incur huge losses and wipe out his/her balance. This raises the question of at what point and at what prices are the trades closed by the broker, if it has the power to do this, and whether it is unfairly and intentionally benefiting from the suspension?. Whilst the margin provides the customer the scope for making large profits, it provides a threat if it is breached. This could easily be brought about by a few, or even a single disastrous trade. The broker’s terms of the trade usually provide that if the margin is breached, it may close the transaction and if the balance with the broker is overdrawn it would be entitled to immediately claim the balance owed.

Over-Aggressive marketing

Some brokers adopt particularly aggressive marketing practices and are effectively ‘boiler room’ operations, also known as ‘bucket shops’. Bonuses have been an important device for some brokers to encourage customers to continue to trade. A bonus added to the customer’s existing balance raises the amount available to trade, causing him/her to risk larger amounts of money and lose their initial deposit more quickly. Whilst brokers often describe bonuses as effectively ‘guarantees’ and ‘insurance’ against losses, this is misleading. The terms usually state that a bonus cannot be withdrawn until trading has exceeded typically twenty times the amount of the bonus. Further, the amount that may be withdrawn is not just limited to the bonus awarded but to that proportion of the total funds (i.e. the balance on the account) the bonus awarded has. All this adds to customer complaints that they are unable to withdraw funds and the refusal by brokers to refund balances is a common complaint by customers.

Final remarks

I have attempted to show how difficult it is for the customer to consistently make profits from forbin, if not impossible, without inside information [4]. All the broker needs to do is encourage customers to keep trading as they will eventually lose their money. Nevertheless, in some cases, brokers act unscrupulously, unethically and, in some cases, fraudulently, to hasten this. It is not surprising that when they have lost, customers complain and blame the brokers and regulators. The problem for regulators and legal advisers is: are the complaints valid? It is outside this paper to list the instances when they have acted against individual firms but it is clear that regulators are so concerned about this that they have effectively banned binary options and are looking at CFDs and spread betting more carefully [5].

I have also shown that forbin is not an investment but effectively betting. Whilst it may be argued that financial instruments such as commodity futures and actual options contribute to market efficiency and perform a useful economic role by providing financial assistance to producers, forbin is outside the market and traders are just making wagers on price changes and, therefore, are contributing nothing to the economy. These traders are, effectively, dealing on a casino and losing potential investment opportunities. Whilst hedging and speculation are acceptable and fulfil a useful economic role, day trading based on guesses does not, and customers should not expect anything other than to lose their money. Because the likelihood of winning is so low and the risks so high, the reason for trading can only be attributed to traders’ irrationality or ignorance about which brokers who run these services are well aware. There are, of course there are exceptions. I know of a trader who made a huge amount of money over a few trades over two days by depositing a few thousand pounds and making large wagers using the maximum permitted margin. When he tried to withdraw his winnings, the broker informed her that his trading was in breach of the terms and conditions of the user agreement and would not pay his winnings.

I have shown here that forbin has recently grown in popularity because of the turbulence in the asset markets. Clearly this is likely to continue as, at the time of writing (January 2021) the economic effects of Brexit, the Trump presidency and the coronavirus are likely to continue. Further, online gambling on the asset and financial markets is convenient for those isolating or furloughed, the winnings are potentially huge (or at least are believed to be) and the markets are largely unregulated can only encourage the attractions of forbin. As their purchase price is simply the stake, what are the values of forbin to customers? If they are unprofitable, they have no value. It has been argued here that binary options, CFDs and spread bets are all unprofitable because (for slightly different reasons) the expected price changes are less than the brokerage costs involved and, therefore, have no value. This is demonstrated in (Table 3) and raises an interesting question: why is Forex so popular as the average price changes for forex is insufficient to cover the costs (around 0.5%) whilst those for stocks and shares and commodities are much higher (around 2.0%) and able to yield sizable profits? Further, as they are based on identifiable factors such as economic and political events and growing conditions in the case of some commodities, price movements are more predictable and potentially usable by traders. I can only surmise that brokers advocate forex rather than other assets as the preferred asset as it is more profitable for them.

The fact that forbin (particularly where forex is being traded) is unprofitable supports the contention that they are often scams perpetrated by brokers using scamming techniques, high powered selling and other schemes (and, at times, simple fraud) designed to extract as much money from customers and as quickly as possible in the knowledge that they will be bought by individuals who do not understand that by trading in this way, they will lose their money. This raises the issue of regulation: whether forbin should be regulated and the extent to which gullible customers should be protected. In my view, they should be regulated and fraudsters should be rigorously prosecuted, but public funds should not be spent compensating victims. It would be unfortunate if forbin were outlawed simply because it has been abused by criminals.

References

- Barnes P (2019) ‘Recent developments in investment fraud and scams: Contracts for Difference (‘CFD’) spread betting and binary options and foreign exchange (‘Forex’) sometimes collectively known as ‘forbin’ - the UK experience’ MPRA Paper 85061, University Library of Munich, Germany.

- James T (2016) Commodity Market Trading and Investment: A Practitioners Guide to the Markets, Macmillan P and Spurga RC (2006) Commodity Fundamentals: How to Trade the Precious Metals, Energy, Grain, and Tropical Commodity Markets, John Wiley & Sons.

- Schwartz ES (1997) The Stochastic Behaviour of Commodity Prices: Implications for Valuation and Hedging. Journal of Finance 52: 923-973.

- Barnes P (2017) Stock market scams, shell companies, penny shares, boiler rooms and cold calling: the UK experience. International Journal of Law, Crime and Justice 11: 1-15.

- Barnes P (2009) Stock Market Efficiency, Insider Dealing and Market Abuse, Gower Publishing Pg no: 1-209.

.

Citation: Barnes P (2021) The use of Contracts for difference (‘CFD’) Spread Bets and Binary Options (‘forbin’) to Trade Foreign Exchange (‘forex’) Commodities, and Stocks and Shares in Volatile Financial Markets. Forensic Leg Investig Sci 7: 055.

Copyright: © 2021 Barnes P, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.